Decision in Principle for Mortgage

DIP For Mortgage accelerator gives an instant decision in principle to retail customers looking for a mortgage.

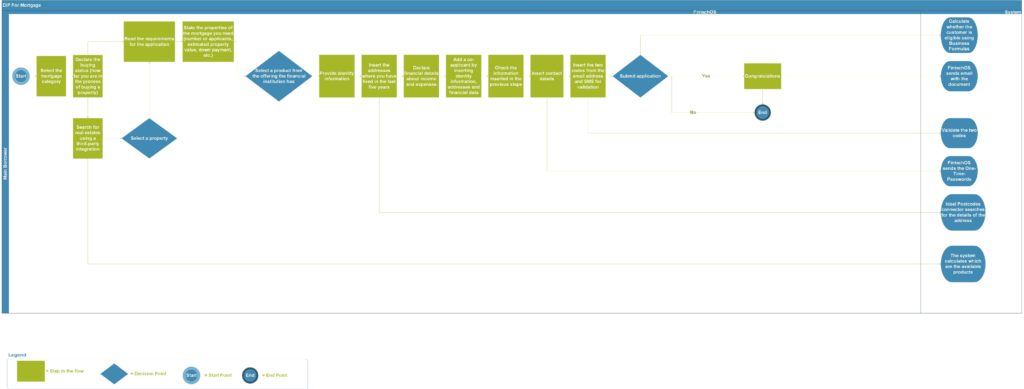

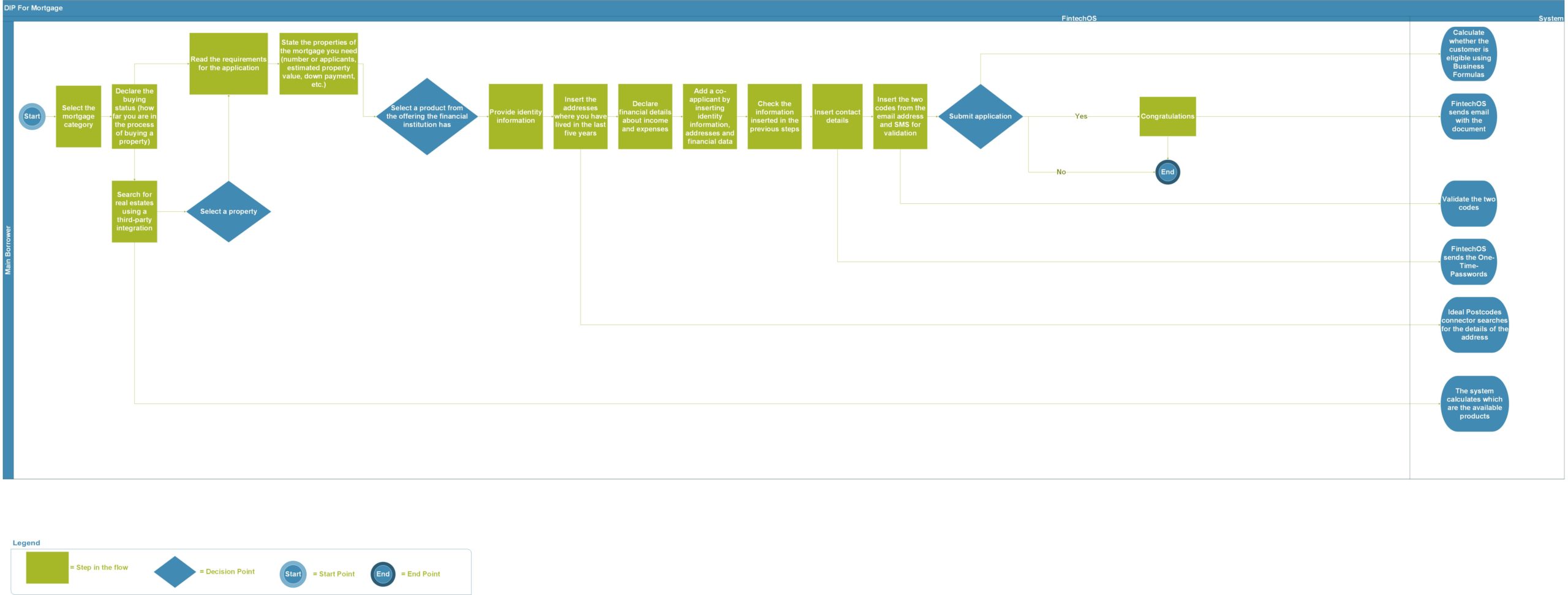

The DIP for Mortgage solution is a digital journey that allows a potential customer to obtain an decision in principle for a mortgage by applying for the loan online. All the steps of acquiring the decision in principle are digital done in one session without having to leave the browser, from selecting the area where the user wishes to buy the property to the identification of the customer. The form driven flow helps the customer find the dream house through the integration with a real estate platform, e.g., Zoopla (other platforms can be accommodated as well). The solution is built around identifying the needs of the customer, followed by adding the data for the borrower and co-borrower. It supports multiple applicants, consequently, only the main applicant has to fill out the application with the data for all the applicants. However, the flow can be modified as per the business requirements with the use of our low-code Innovation Studio platform. It saves time to firstly find out whether you as a customer are eligible for the mortgage, and then begin the application. Additionally, the process accommodates the flow for adding a co-borrower. The user is an un-authenticated customer (a new customer to the financial institution) and the customer segment is retail.

Value proposition:

Streamlined decision in principle . All the customer data is filled in by the user in a single sitting and the response is instant

Multiple applicants. The DIP can offer instant response for applications that include a co-applicant. The hole process can be covered by the main applicant so there is no need for the co-applicant to be present when applying online.

Fast. The DIP process is designed to help the consumer get a decision in just minutes.

Cost free. The DIP leverages the information declared by the user and only has a soft bureau check as a third party interrogation so that the process dos not create additional cost to the lender

Help center. A designated help center with co browsing capabilities that help the user every step of the way

UI/UX. Comprehensive experience from the start until the DIP response.

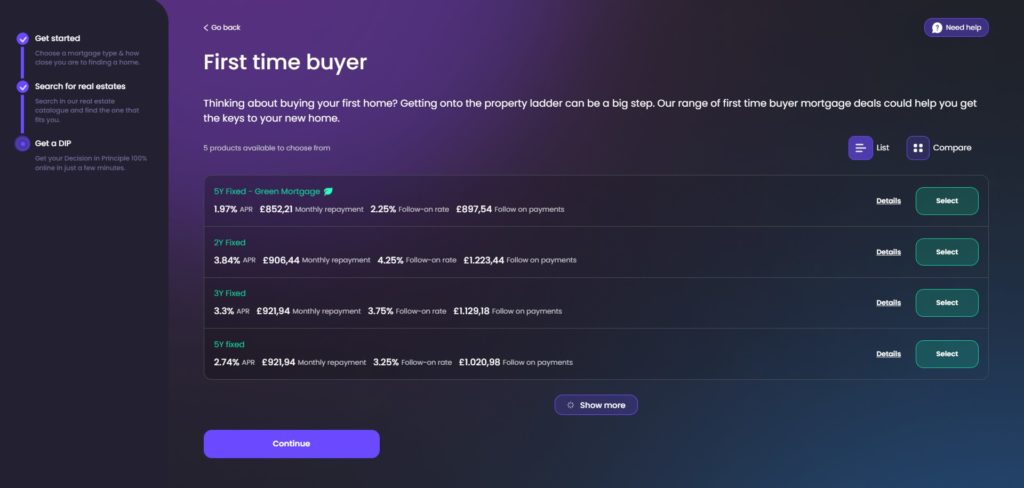

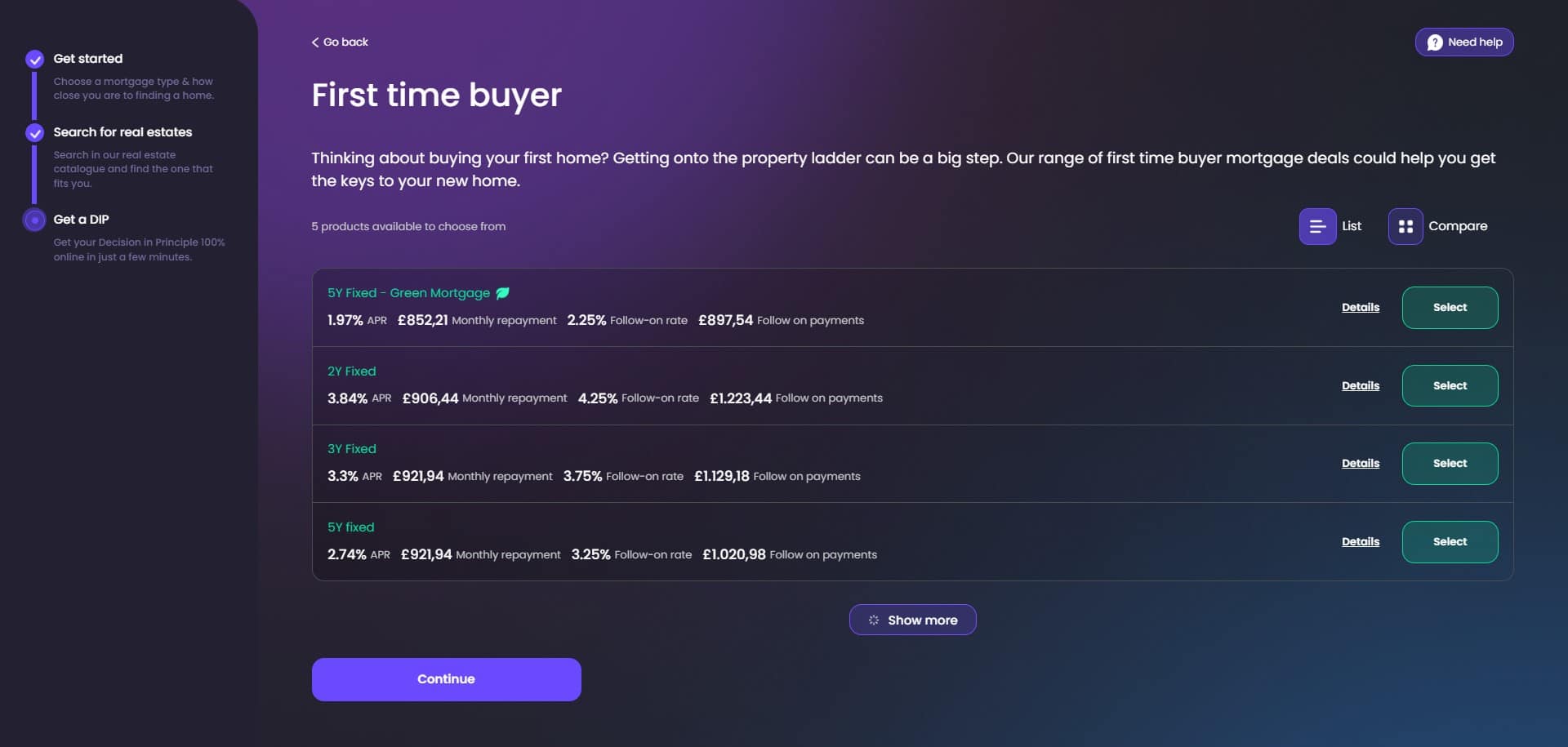

The DIP for Mortgage solution is an instant decision in principle for the borrower to be able to check whether they are eligible for a potential mortgage. The online process accommodates three big steps that inform you in a few minutes what is the bank offer and whether or not you can apply for one of those offers. The solution offers in addition a Zoopla integration to help you find a property. Any other third-party platform can be integrated. The business context of this solution is a pre-eligibility determination of a customer to enable them to receive the funds necessary for moving forward in their property buying process. The accelerator contains:

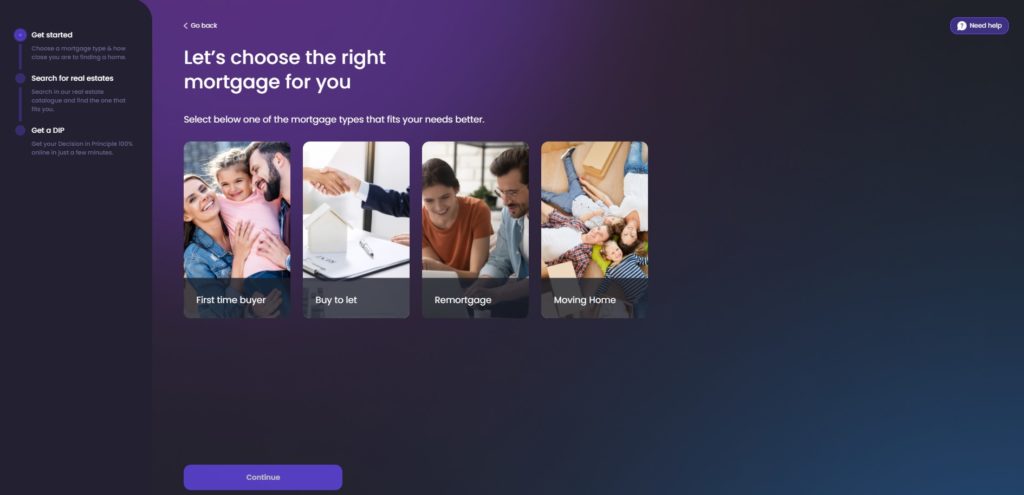

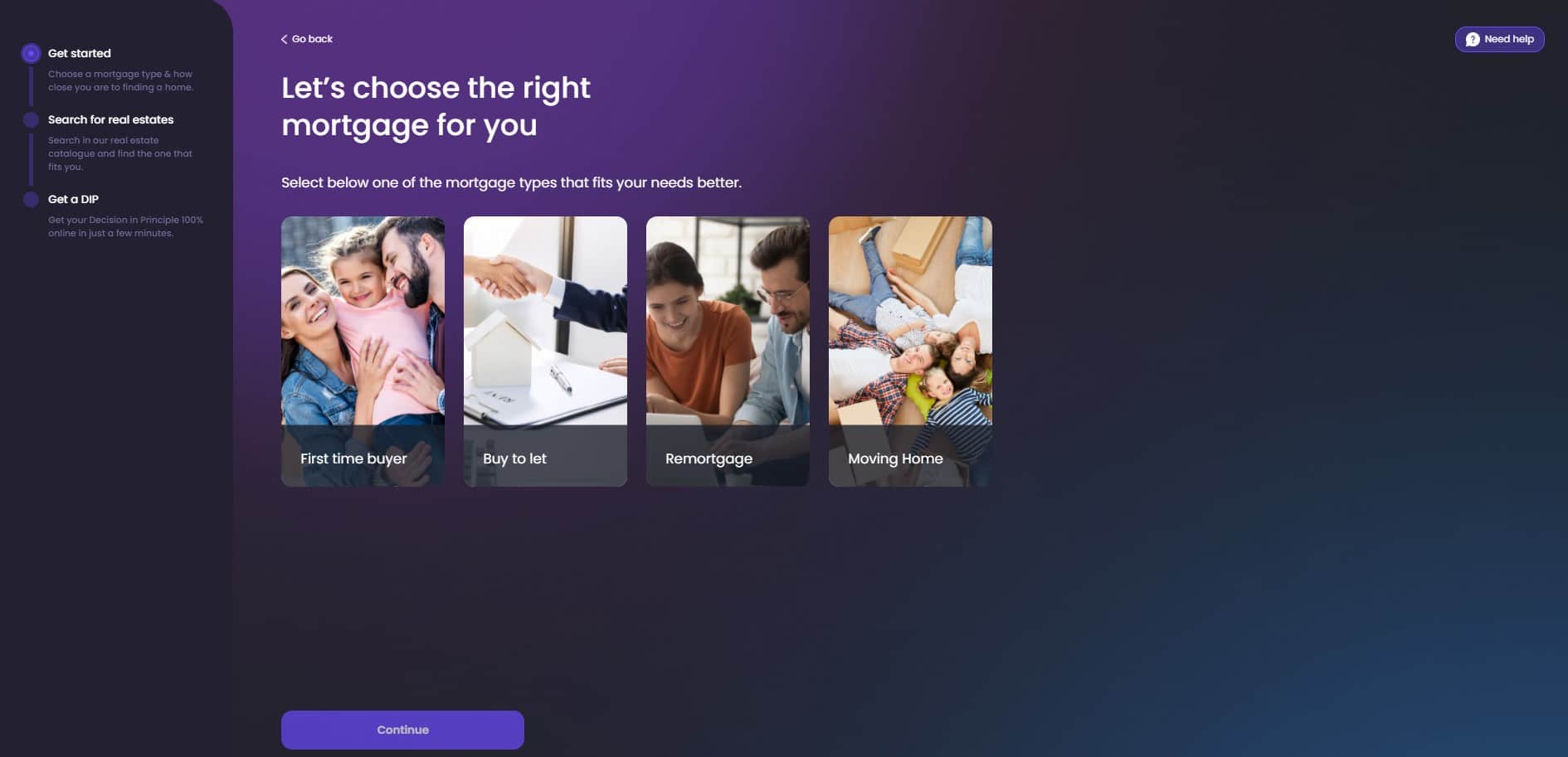

- Get Started: where you select the reason for looking for a mortgage and how advanced you are in finding a property

- Searching for Real Estates: where you can look for a property that matches your needs. It is an optional step.

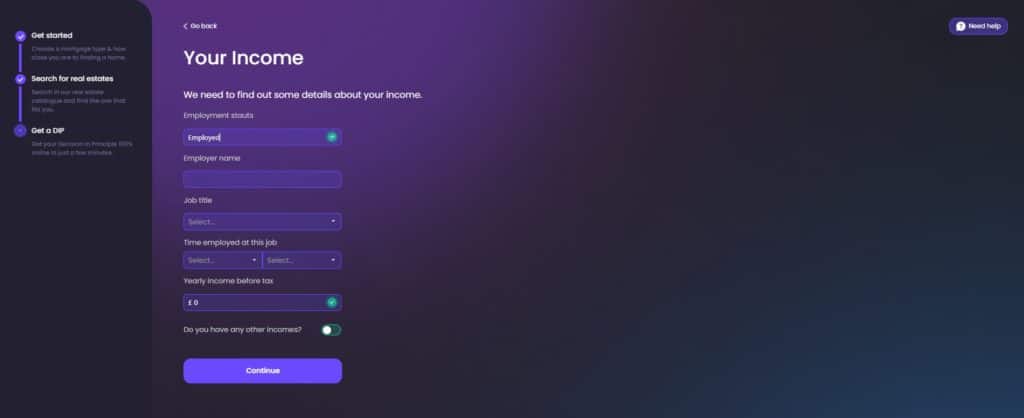

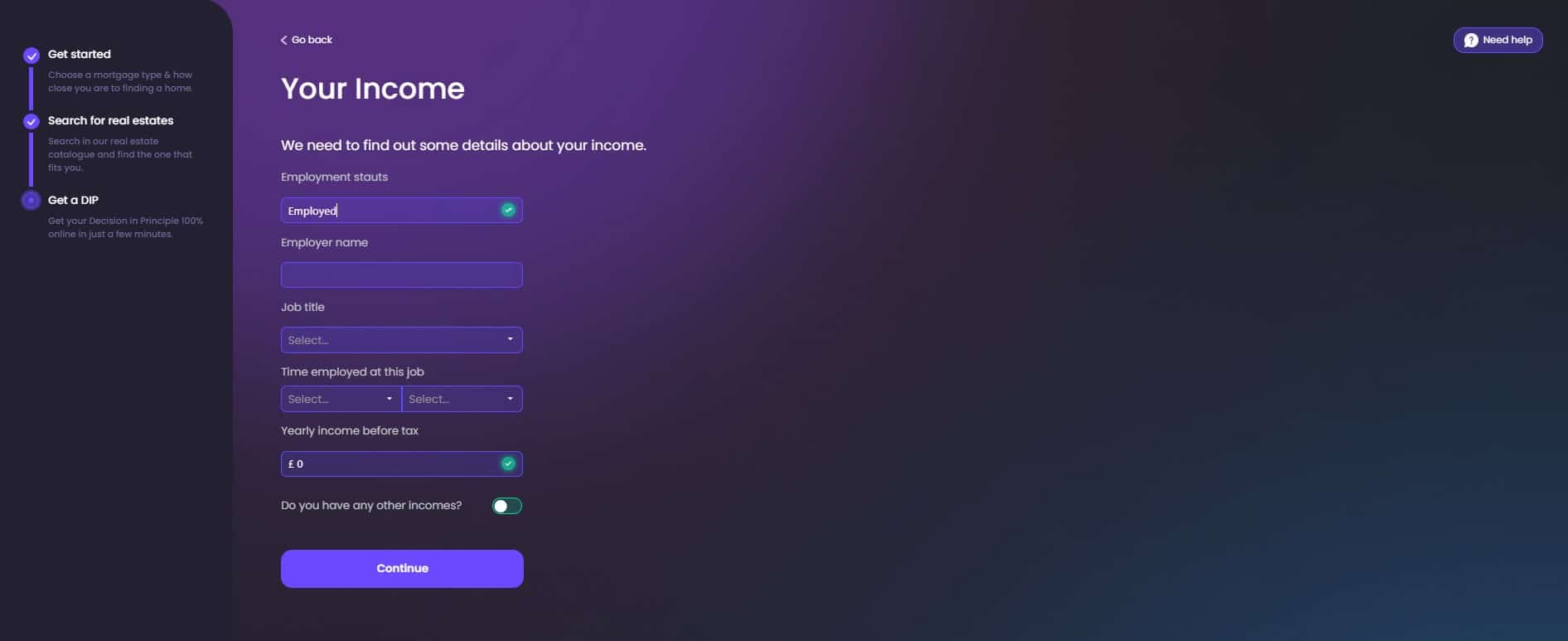

- Getting a DIP: where you insert personal and financial information about the identity of the main borrower and, optionally, that of the co-borrower. That information is later used in advanced calculations to determine your eligibility. An email is sent containing the decision in principle document that was generated by Configuring the Digital Documents Processor.

More details here.

- Standard FTOS infrastructure (with B2CPortal, B2CProxy, JobServer, MessageBus, MessageComposer for the Contact Validation) v22.1 as explained here

- Banking Product Factory v3.0.2

- OTP project (found in the folder DIP for Mortgage-v1.0.0.zip > prereq)

- B2C Setup project (found in the folder DIP for Mortgage-v1.0.0.zip > prereq) or a manually configured B2C security role assigned to the Guest user and a front-end domain named B2C.

- FAQ Module (for details, see here)

- Optionally, consider the Ideal Postcodes, Zoopla and Core Banking integrations which are subject to internal implementation.

More details here.

DIP Mortgage

Version 1.0.0

StablePublished on 27 May 2022 by FintechOS

Requirements

- Standard FTOS infrastructure (with B2CPortal, B2CProxy, JobServer, MessageBus, MessageComposer for the Contact Validation) v22.1 as explained here

- Banking Product Factory v3.0.2

- OTP project (found in the folder DIP for Mortgage-v1.0.0.zip > prereq)

- B2C Setup project (found in the folder DIP for Mortgage-v1.0.0.zip > prereq) or a manually configured B2C security role assigned to the Guest user and a front-end domain named B2C.

- FAQ Module (for details, see here)

- Optionally, consider the Ideal Postcodes, Zoopla and Core Banking integrations which are subject to internal implementation.

More details here.