Mortgage Calculator

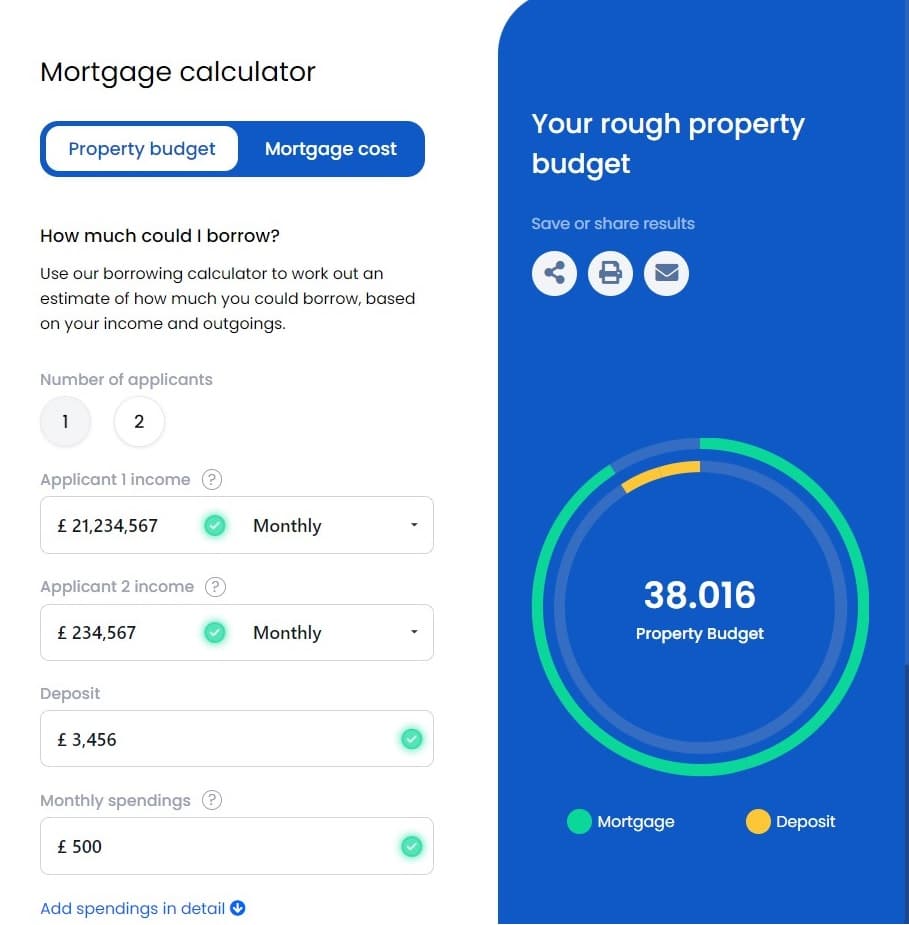

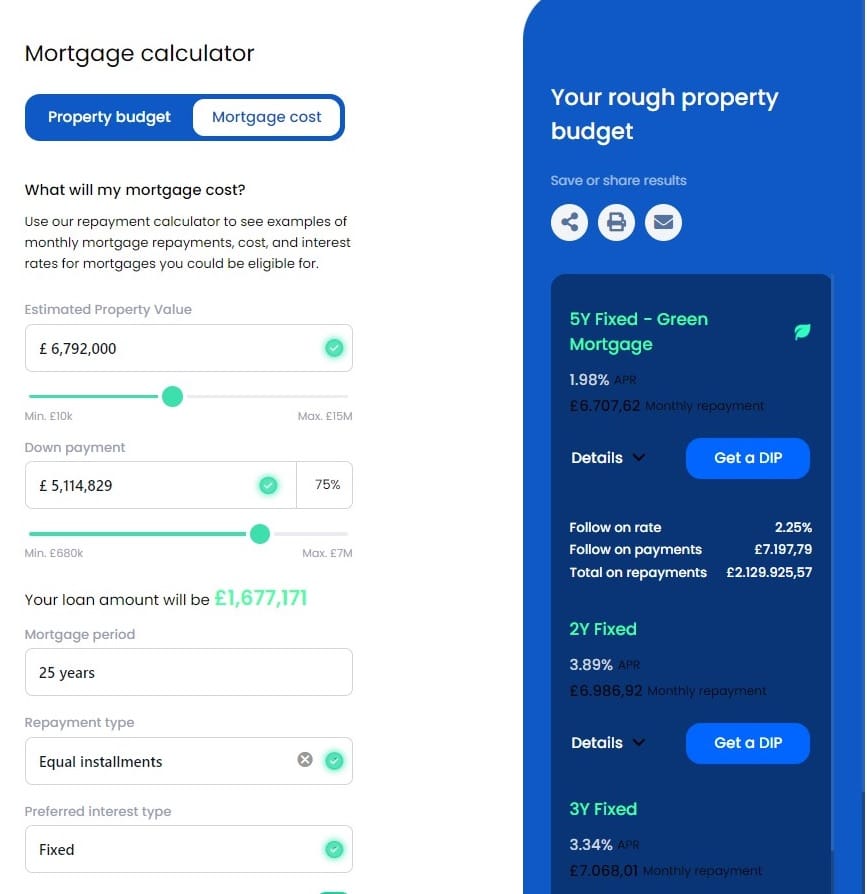

Mortgage Calculator grants users instant calculations for two questions, the products a potential customer is eligible for and the cost of the mortgage.

Before applying for a mortgage, consumers wish to know the amount they are eligible for and the costs involved. Each bank has slightly different offers, therefore knowing exactly for what amount you qualify without any commitment, i.e., a contract, is a plus in user experience. FintechOS offers a B2C portal with two simulators. Hence, an un-authenticated customer (a new customer to the bank, un-authenticated in the FintechOS Portal) can know in seconds what type of loan they qualify for. It serves as a starting point to launch the mortgage application.

This page has the functionality to simulate the loan application and return to you, the applicant, a result for your loan request. It can be embedded in a bank’s website to offer its clients a quick way to find out if they qualify for any of the mortgage products that are being offered. From this page, the customers can access the Mortgage digital journey containing the steps to acquiring the loan amount (selecting a mortgage type, finding a property, declaring financial data, getting an insurance for the property, signing the contract).

Value proposition:

Seamless CX: customers can in no time check the costs of a mortgage and available offers. Complete transparency in a modern designed widget, easy to reach.

Omni-channel: easy to embed into the bank’ website, mobile/online banking app or make it available to its agents, brokers, advisors or any 3rd party (i.e. real estate agents)

Perfect fit Product Offer. Hook up customers with a simple widget allowing them to easily check out, in not time, what home they can afford and applicable costs. The first lead generation instrument readily available, plug & play.

The accelerator Mortgage Calculator is composed of two simulators that aid both customers and back-office employees to determine two important pillars in the decision of acquiring a mortgage: the products the customer is eligible for and the cost of the mortgage. These are the two delimiting factors for the customer to make a commitment.

The calculator can be used in the following two scenarios:

- customers accessing the official website of a bank to get information about the mortgage offer and from the calculator to receive a DIP for Mortgage

- bank employees to give a fast answer to customers in the branch or from the call center informing them of the product options that are suitable, what costs a mortgage implies and the proportions of the deposit and that of the mortgage and even launch the DIP for Mortgage.

More details here.

Install and configure:

-

- Standard FintechOS infrasturcture (with B2CPortal and B2CProxy)

- Banking Product Factory v3.0.2

- B2C Setup project or a manually configured B2C security role assigned to a guest user and a frontend domain named B2C.

More details here.

Mortgage Calculator 1.0.0

Version 1.0.0

StablePublished on 27 May 2022 by FintechOS

Requirements

- Standard FintechOS infrasturcture (with B2CPortal and B2CProxy)

- Banking Product Factory v3.0.2

- B2C Setup project or a manually configured B2C security role assigned to a guest user and a frontend domain named B2C.

More details here.