Buy Now, Pay Later

Launch your BNPL product in less than 3 months with a plug & play solution to effectively compete in a challenging, fast-growing context.

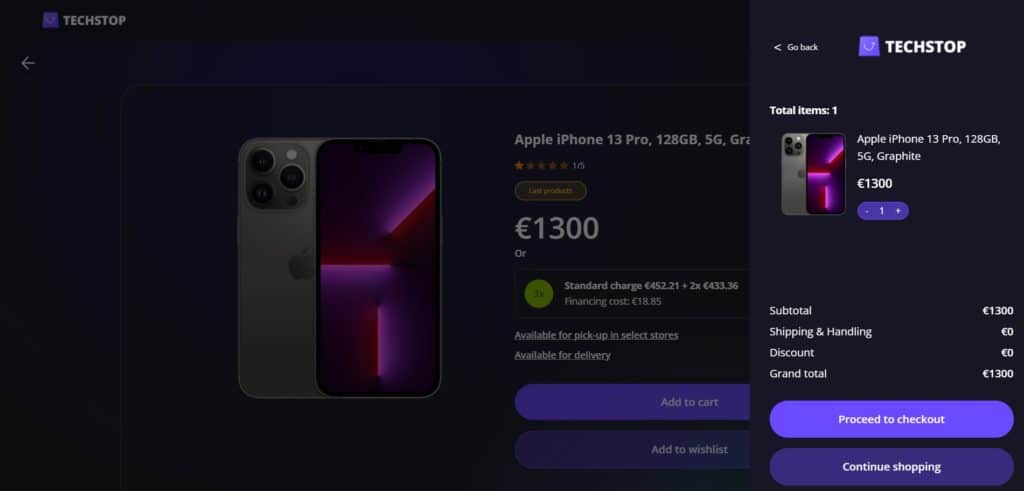

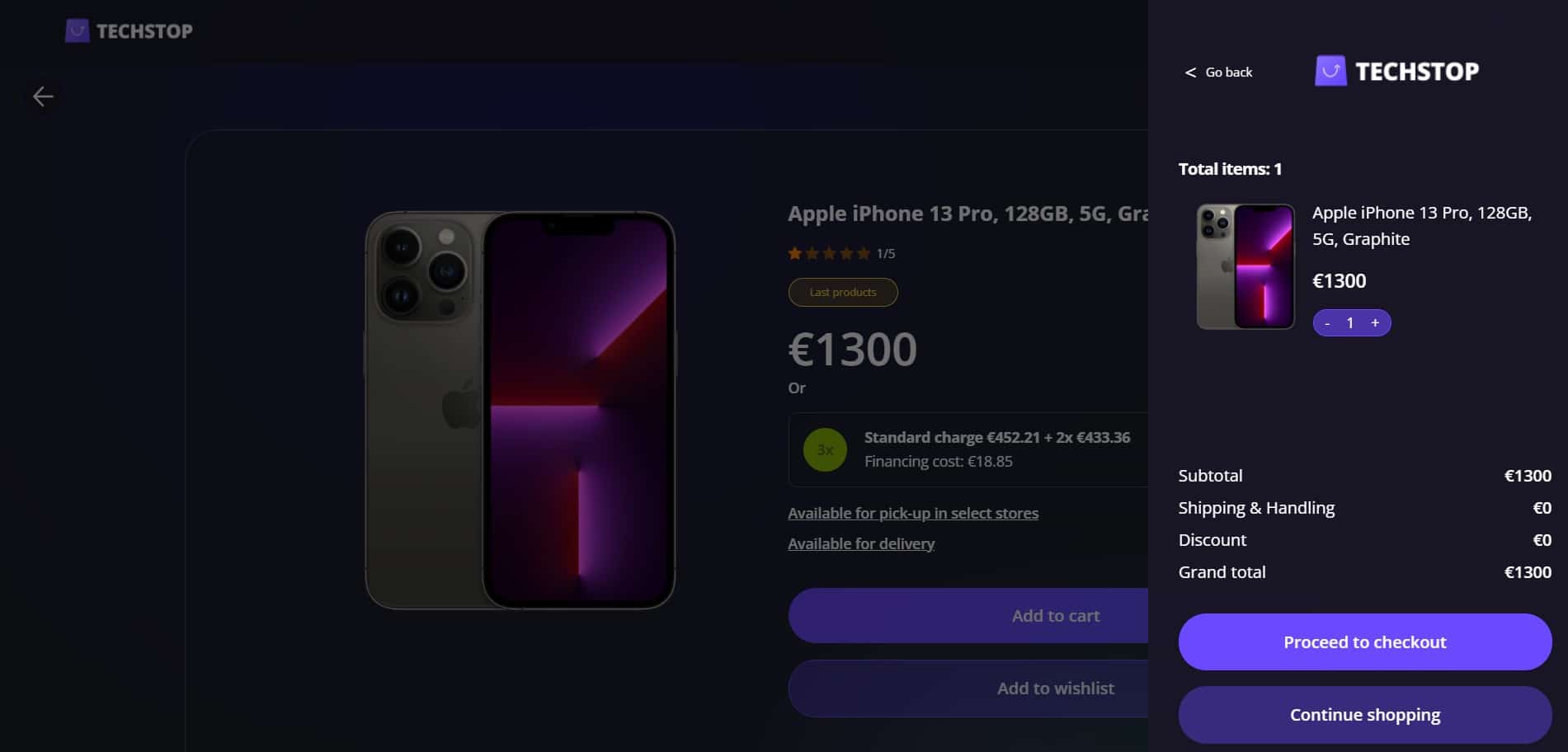

Buy Now, Pay Later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them at a future date, often interest-free. The Buy Now, Pay Later solution is a digital journey that allows customers to obtain a loan for consumer needs. The application process is tied to the checkout solution for the marketplace so that the experience is seamless and very fast compared to a more classic loan offering.

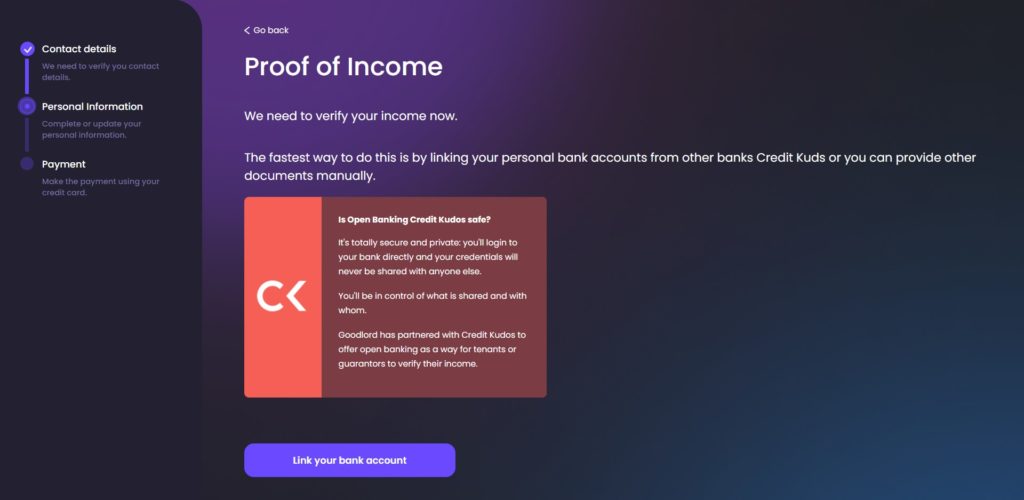

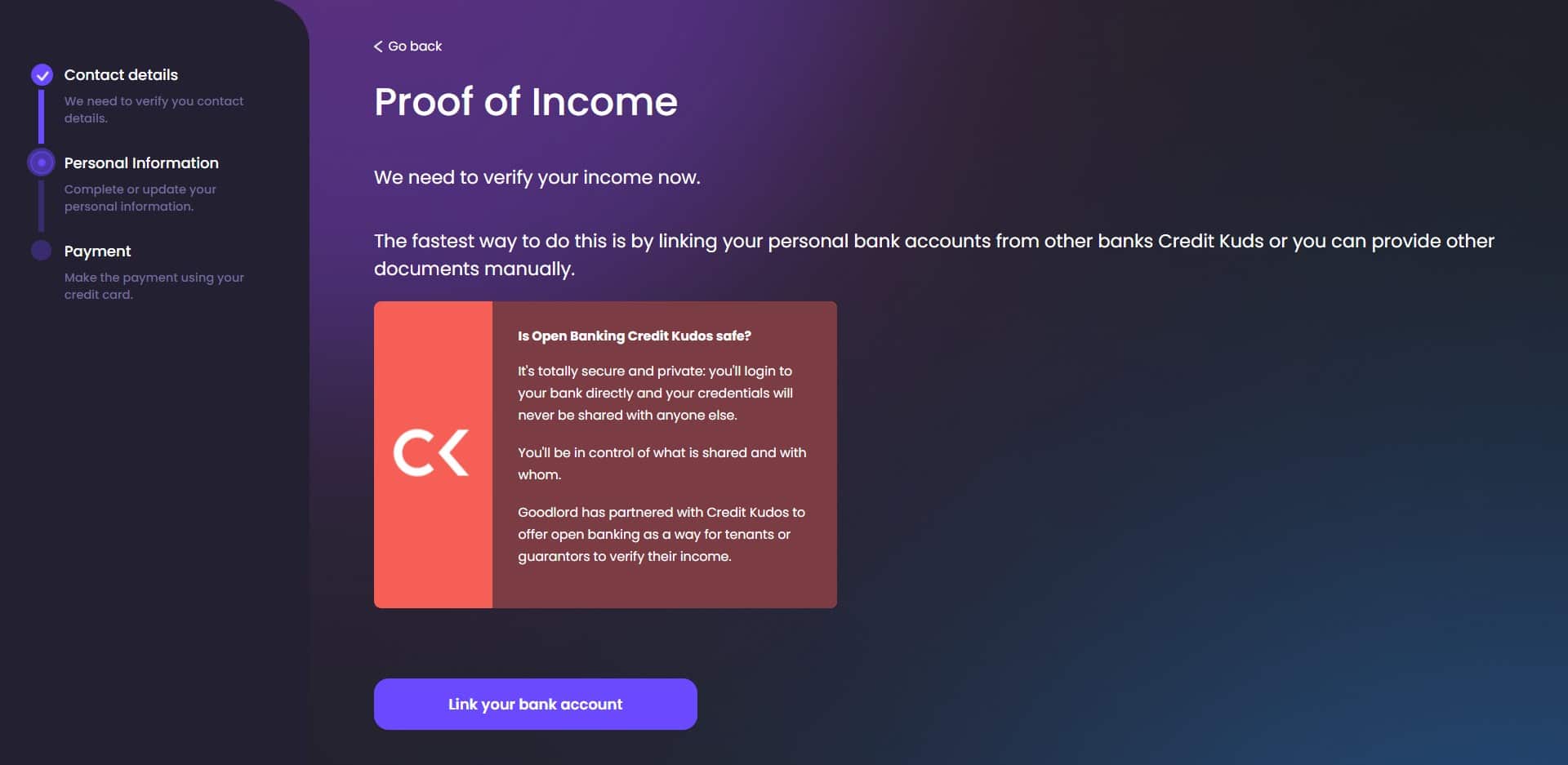

The solution is also built to handle multiple types of scoring mechanisms, from a fully integrated user score based on the marketplace behavior to a more classical approach with Credit Bureau checks and Open Banking capabilities. The solution employs an Open Banking method for markets where financial institutions must perform income checks.

The journey is accessible through APIs, therefore the accelerator integrates with any marketplace for a seamless experience, for example, e-commerce websites for electronic goods or clothing websites.

Key differentiators:

Fast track approval process. The underwriting process for customer can be as easy as confirming some personal details. This is enabled by calculating most of the risk before the customer proceeds with the BNPL payment option in the marketplace checkout.

Personalized product. The solution has the ability do filter the type of BNPL products available at checkout based on the customer risk profile, this helps to significantly reduce the possibility for a user to not get approved.

Seamless CX on checkout. For returning customers, they journey will usually take just 5 taps to complete after he chooses to pay with a BNPL in the marketplace. Even for new customers, the process usually requires to will in the contact details, name and surname and the date of birth (if not available from the marketplace).

Flexible decision models. the solution can be adapted to fit most risk scenarios, leveraging data from the marketplace, lender and third-party providers. We included 2 variants for scoring that the lenders can choose to start from when configuring the accelerator. 1 – leveraging data from the marketplace. 2 – independent from any marketplace data and more traditional banking retail style with KYC and Bureau checks data.

Easily & perfectly embedded journey to quickly onboard any new merchant. all the journey is available to be orchestrated via API’s, from end to end. Post granting APIs orchestration can be done to trigger also return of good in Core Banking.

Third Party Agreement empowering efficient and automate settlement. We enable management of 3rd parties as brokers in the Core Banking where we can capture the details about agreement, how BNPL lending can be monetized in a broker/agent manner, automated invoicing and settlement (reconciliation) based on loans intermediated.

BNPL Loan Management Activities. We manage return goods & costs recalculation, early repayment, support other admin activities.

Exposure monitoring. Lenders can better control their risk exposure by merchant using the Limits for Customers & Merchants and receive notifications in case for a certain product the limit is exceeded.

The Buy Now, Pay Later accelerator has a few stages to ensure fast delivery of a BNPL product:

- select a product from the marketplaceFintechOS built a dummy e-commerce website to serve as a starting point, however, you can integrate the Buy Now, Pay Later accelerator to your website for your customers to acquire products using this type of loan. For details, see Calling the Solution within a Journey.

- select a Buy Now, Pay Later product present in Configuring the Banking Products

- sign into your account or create a new account

- insert your email address and phone number for validation with two One-Time-Passwords

- complete your account with additional identity information based on the risk level the platform calculates

- use Credit Kudos to prove your income and link an account

NOTE

This third-party platform is a recommendation from FintechOS. Credit Kudos enable businesses to leverage Open Banking to enhance affordability and risk assessments. It stores store the following data: account details (account name, number and sort-code, account balance, card number, account transactions (details of incoming and outgoing transactions, and contact details (address, telephone numbers and email address as held by your bank/card issuer). However, any other third-party system with exposed APIs can be integrated.

- scan an ID document and take a selfie for security reasons using OCR and Processor Setting for Liveness

- add your credit card details to pay for the first instalment or choose from a list of saved cards

- give feedback on your experience.

More details here.

This version is compatible with High Productivity Fintech Infrastructure v22.1. The supported operating system is Microsoft Windows 10. The supported browser is Google Chrome.

- Standard FTOS infrastructure (with B2CPortal, B2CProxy, JobServer, MessageBus, MessageComposer for the Contact Validation) v22.1 as explained here

- Banking Product Factory v3.0.2

- OTP project (found in the folder Buy Now, Pay Later-v1.0.0.zip > prereq)

- B2C Setup project (found in the folder Buy Now, Pay Later-v1.0.0.zip > prereq) OR a manually configured B2C security role assigned to the Guest user and a front-end domain named B2C.

- Optionally, consider the Credit Kudos and Core Banking integrations, which are subject to internal implementation.

For more details please access this link.

Buy Now, Pay Later

Version 1.0.0

StablePublished on 25 May 2022 by FintechOS

Requirements

-

- Standard FTOS infrastructure (with B2CPortal, B2CProxy, JobServer, MessageBus, MessageComposer for the Contact Validation) v22.1 as explained here

- Banking Product Factory v3.0.2

- OTP project (found in the folder Buy Now, Pay Later-v1.0.0.zip > prereq)

- B2C Setup project (found in the folder Buy Now, Pay Later-v1.0.0.zip > prereq) OR a manually configured B2C security role assigned to the Guest user and a front-end domain named B2C.

- Optionally, consider the Credit Kudos and Core Banking integrations, which are subject to internal implementation.

After the FintechOS environment is installed, proceed with the next steps.

Details here.