Lexis Nexis Connector

Ensure customers a seamless digital journey by automating all compliance, fraud and KYC checks via the out-of-the-box Lexis Nexis connector.

Connectors are simple, data point connections to external Saas providers, that are used to enrich internal customer data to help in onboarding and risk decision scenarios. API Connectors gather data from a collection of REST APIs with the purpose of merging them into a cloud-based data storage system. This process gives the possibility of filtering and transforming data into a proper format or structure for the purposes of querying and analysis.

FintechOS offers the possibility of accessing different databases with the purpose of moving around specific data using API connectors. They can be used but are not limited to banking or insurance business scenarios, such as customer identity verification in a loan origination operation, automatically fill-in customer data, and so on. In addition, connectors can have a significant role in a business’s risk management process by providing easy access to databases where information regarding financial risks is stored.

LexisNexis Bridger Insight XG is a platform that accesses identity verification, screening, due diligence and fraud prevention services in order to efficiently aid the Know Your Customer (KYC) processes and to make sure the institution is compliant with financial regulations.

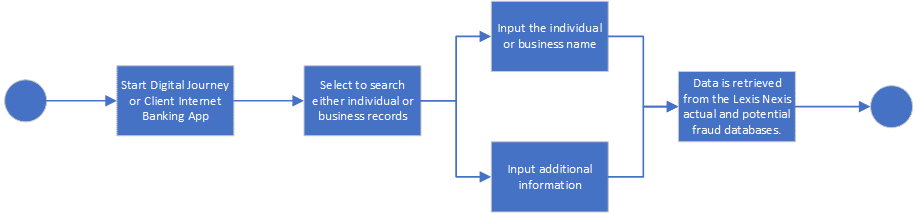

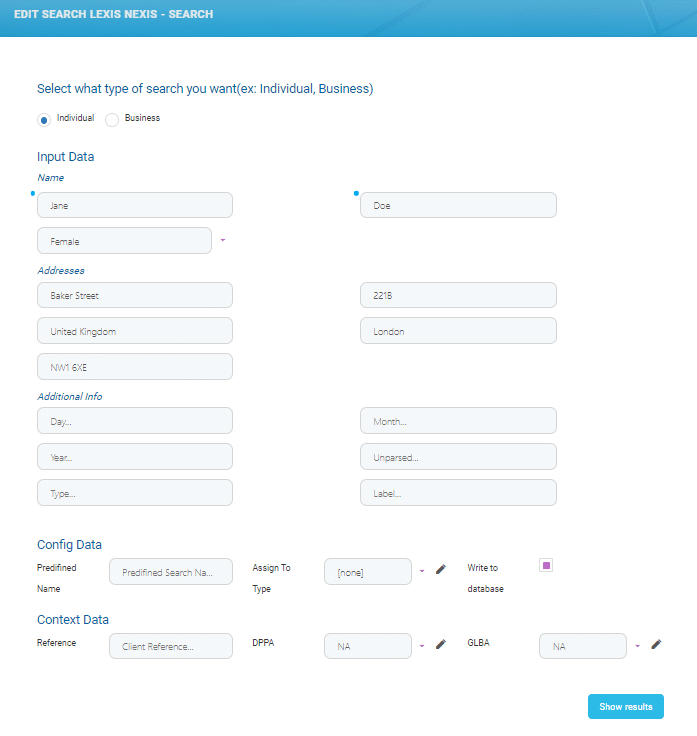

The FintechOS Lexis Nexis Connector simplifies the customer verification process by allowing financial institutions to easily add it to their digital journey. Once integrated to the digital journey, the API connector calls a number of REST APIs in order to retrieve the following data:

- Basic person search to retrieve information such as name, date of birth, address, gender, and so on.

- Basic company search to retrieve information such as name, address, registration number, and so on.

- Full search to retrieve any possible information either person or company data.

In addition to aiding and accelerating account openings, the LexisNexis Bridger Insight XG simplifies SWIFT, International ACH and FedWire Payment Screening. It helps fight financial crime by supporting the resolution of critical BSA/Anti-Money Laundering (AML) and Customer Identification Program (CIP) and KYC compliance requirements. As a result, it reduces risk exposure with enhanced due diligence data.

The FintechOS Lexis Nexis Connector offers the possibility of accessing and retrieving individual or business information by searching in databases for fraud or potential fraud. LexisNexis Bridger Insight XG is a risk management product that aids financial institutions by simplifying and accelerating the Know Your Customer (KYC) process. In addition, when searching the Lexis Nexis databases through the connector, it allows for configurations such as: determining which settings to use, as well as storing the results in the LexisNexis Bridger Insight XG database.

LexisNexis Bridger Insight XG is the screening tool to use for individuals or business customers and their legal representatives. In addition, the Lexis Nexis platform offers access to a payment screening tool that returns alerts set within the World Compliance part of Bridger Insight XG. These features help the onboarding process of a new customer or business but it’s also used for further monitoring purposes and payment screenings.

This means that the financial institution is alerted if any changes that break regulatory obligations appears. The procedure is simple, a search is made by the bank clerk or anyone authorized to use the platform and results are retrieved. The returned data can either point out that no matches are found or that an alert is found. The generated alerts have a confidence score rating up to 100.

More details here.

- Obtain the Lexis Nexis user role, name, and password.

The user role, name, and password are obtained by the customer from Lexis Nexis once a contract is established.

2. Install the package from the App Store on an environment FintechOS 21.1.6.0 and above with the Studio, Portal and B2C Portal configured. For details on B2C, see Setting B2C Environment.

3. Configure the JobServer.