Online and Mobile Banking

Online and Mobile Banking grants individual and business users the possibility to access and manage their financial products whenever they need, from anywhere, completely self-service through a modern user interface and state of the art UX.

This solution grants individual and business users the ability to access and manage their financial products whenever they want, from anywhere, and completely self-serve through a modern user interface.

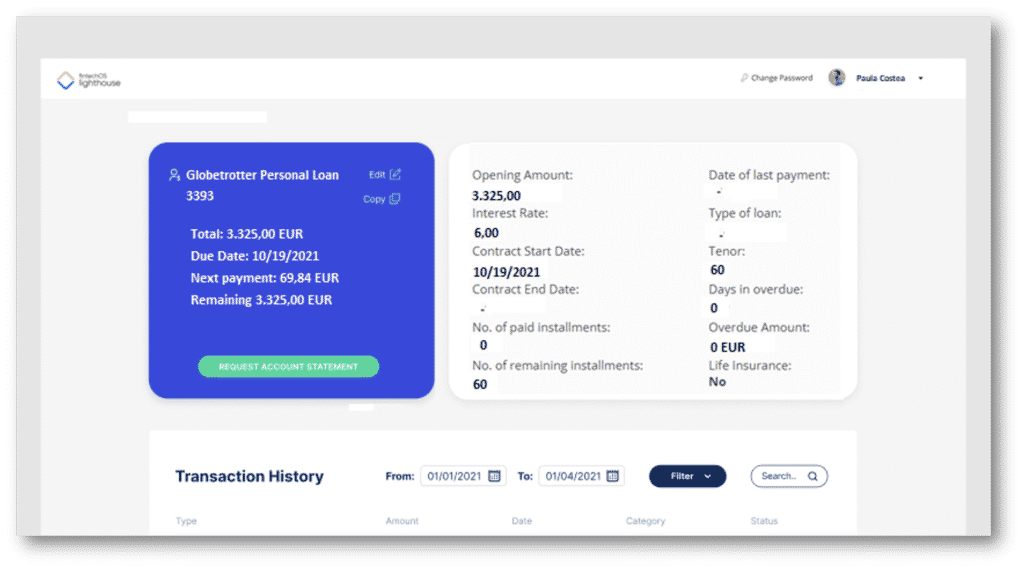

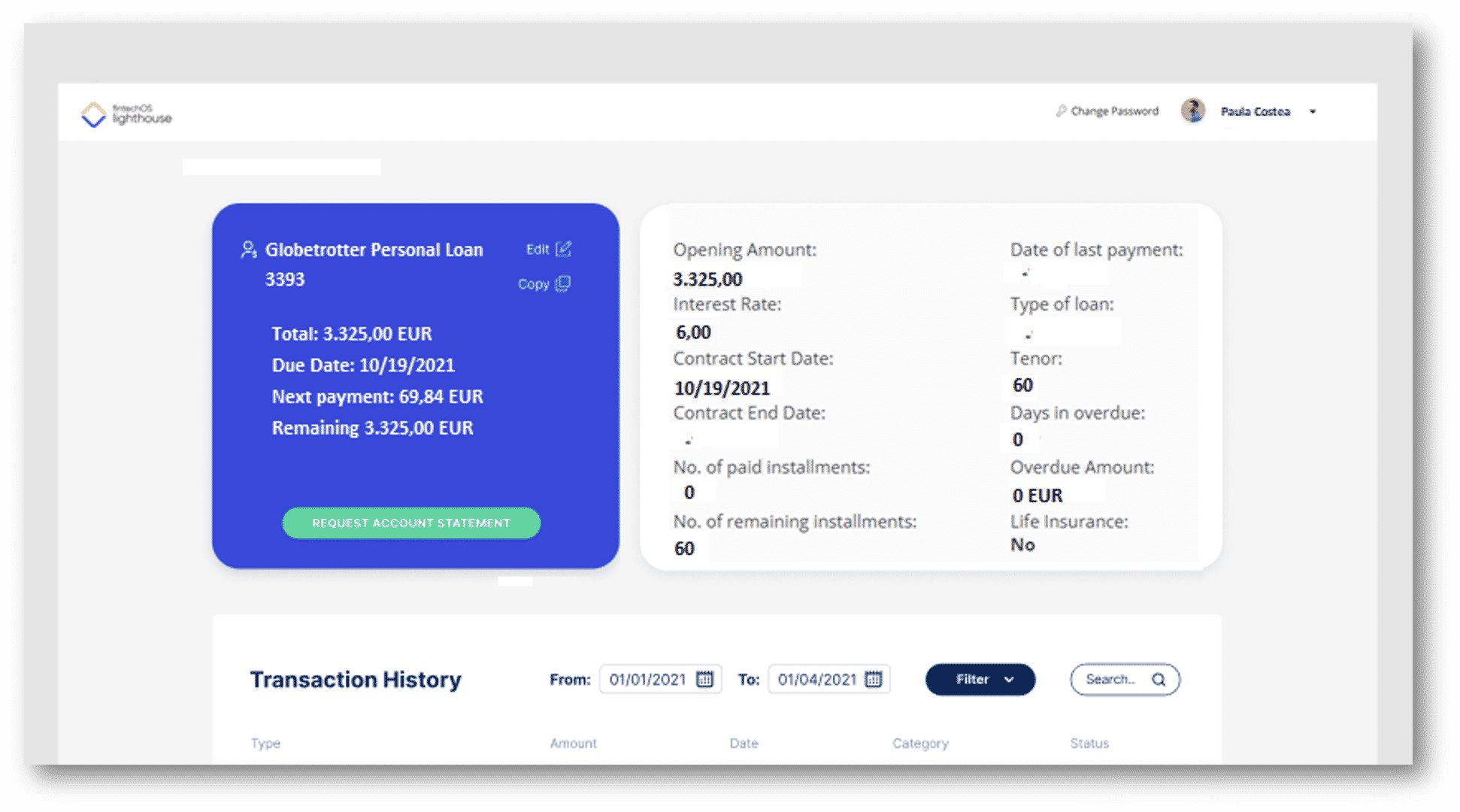

FintechOS’ online banking solution allows customers to access a simple, streamlined dashboard. With this, they can:

- visualize any type of portfolio products;

- make local or international payments;

- pay utility bills or make bulk file payments;

- check their transaction history and generate account statements.

The solution offers full flexibility, allowing end-users to use the same credentials for private individual accounts as well as any business accounts. The payments module adapts automatically to the information typed in by the end-user and displays the required fields for each payment schema type, making it very easy for any end-user to transfer money, without having to know anything about payments.

Advantages:

– Intelligent payments. The payment page adapts automatically to the information inputted by the End User and displays the required fields for each payment schema type.

– Degree of parametrization possibilities for the financial institution

- allows to select which type of payment schemas they have implemented and the application will automatically permit or disable on the sport that flow from the intelligent payment screen

- possibility to enable on a touch of a button any new payment schemas that the financial institution might adhere to in the future

– Speed of delivery

– Hyper-personalization and Flexibility to define Strong Customer Authentication exceptions (the threshold for payments and events for which SCA should not be required) in total compliance with PSD2

– Mobile browser-based, web-responsive

– Any type of payments – ready to plug-in:

- Intra-bank Own Account, Intra-bank Other Customer

- Foreign Exchange

- LCY Instant Payments (e.g. Faster Payments, Blink, Instant Payments)

- LCY Small Value domestic payments (e.g. bacs in UK, SENT in RO, BISERA in BG, etc.)

- LCY High-Value domestic payments or Urgency (e.g. Regis in RO, RINGS in BG, etc.)

- SEPA Instant EUR

- SEPA Credit Transfer

- TARGET2 EUR

- Non-SEPA SWIFT Payments.

The degree of out of the box parametrization possibilities for the financial institution has been expanded, covering all specific needs related to payments, and:

-

- allows users to select which type of payment schemas have been implemented; the application will automatically permit or disable the sport that flows from the Intelligent payment screen

- enables new payment schemas that the financial institution might adhere to in the future with an extremely short time to market

The FintechOS list rules signature engine covers any complex case for authorization limits and joint signature rights.

The Online and Mobile Banking solution has all required security, authentication, and authorization processes in place, granting financial institutions and customers a secure experience, fully compliant with PSD2.

For future versions, we are looking at integrating account aggregation, PFM/BFM, loan origination and self-servicing, deposits & savings, value-added services powered by an embedded marketplace.

The Online and Mobile solution enables a bank representative to register users to an online and mobile banking service and administer their profiles accordingly. The users can be:

- individuals who can register to have access to their own accounts online/ mobile.

- individuals who can register to have power of attorney rights on another individual’s accounts through online/ mobile banking.

- individuals who can register to have power of attorney rights to a company’s accounts (which they work for) through online/ mobile banking.

By having access to online/ mobile banking, transactions can be initiated, payments can be performed, and accounts’ balance and loans can be monitored. Hence, a large enterprise or an SME is the customer of a bank and the bank has a list of users who represent the company and SME. Those users are allowed to make payments and act on behalf of the company. For example, a particular bank has a customer named TechiesOnline who sells computer parts. The SME has three users who pay the salaries and make payments to suppliers.

A customer is a legal entity/ individual with bank account(s).

A user is an individual who applies in this process to have access to Internet & Mobile Banking where the accounts of a legal entity/ individual/ own accounts exist.

Types of transactions supported by the system

- Own Account transfers

- Domestic payments

- Budget Payments

- Foreign currency payments

- Bulk payments

- Open New Products.

Other services include:

- Account balance & Details

- Account statements

- Initiate payments.