Policy Admin

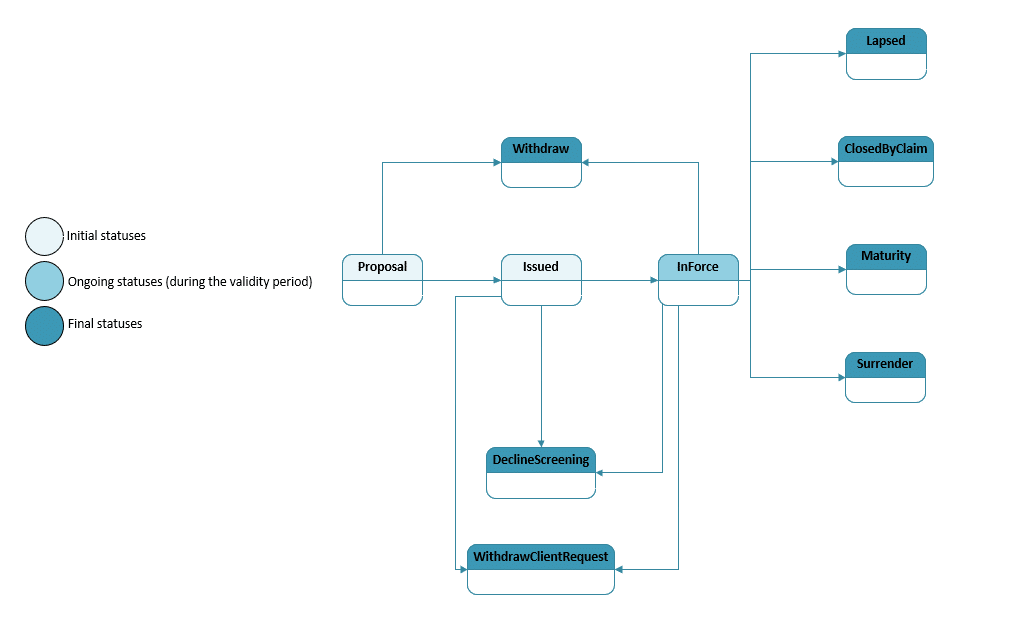

Policy Admin is designed to allow you to manage all aspects of the typical policy lifecycle including issue, suspension, mid-term adjustments, lapses, maturity, renewal, cancellation and changing payment method.

Policy Admin is designed to support your insurance policy lifecycle(s) by allowing you to design and control the transition between business status e.g. quote to issued, or in force to lapsed. Policy Admin also provides the functionality for you to manage mid-term adjustments, both via back office and customer self-service portals.

The Policy Admin module can be fully customized in FintechOS Studio, enabling you to match your specific requirements and your preferred policy lifecycle. By using Policy Admin as a foundation you will shorten your implementation time and ensure that each component fulfils your specific needs. Additionally, by using Policy Admin with other FintechOS Automation Processors you will be able to digitize other workflows and improve accuracy, while reducing the amount of time spent on routine business operations.

KEY FEATURES

- Policy generation and issuance,

- Easy visualization of policy repository,

- Policy report generation,

- Update payment types,

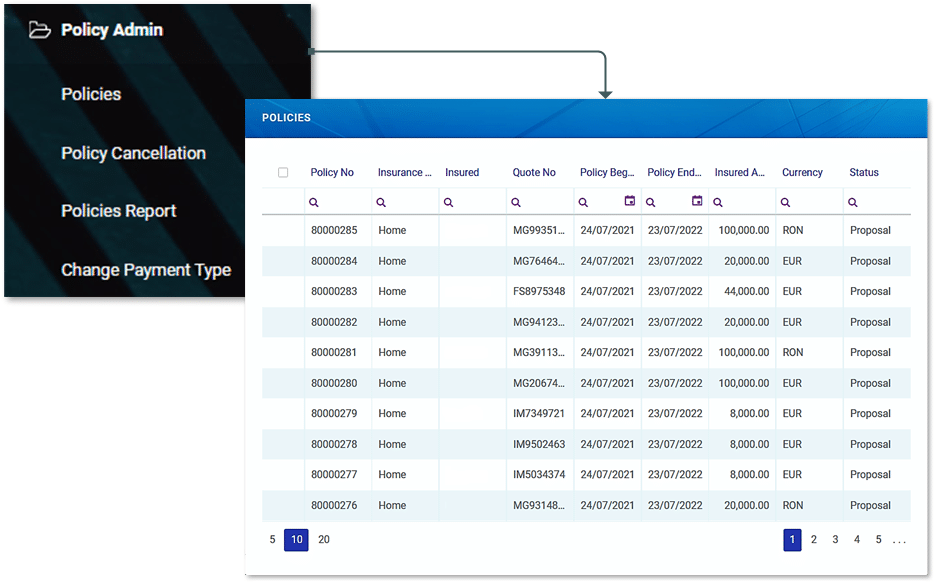

- Policy

- Cancellation,

- Renewal,

- Lapse,

- Mid-term adjustment including additional/return premium calculations.

The Policy Admin digital journey is designed to offer you a streamlined route for managing the policy lifecycle. The solution includes the following key workflows:

- Creating a Policy – The policy issuance process represents the main Policy Admin functionality through which the insurance contracts are generated within the core system; it provides the basis of all the other Policy Admin workflows. The core system has the ability to integrate seamlessly with external systems and digital channels which means from a business perspective you can validate the data provided and automatically generate a policy record without manually re-keying customer data.

- Policy repository – used for storing and managing your digital insurance policies.

- Policy Cancellation flow – for managing cancellation processes; from registering and validating policy cancellation requests, to calculating the amount to be returned and approving payments.

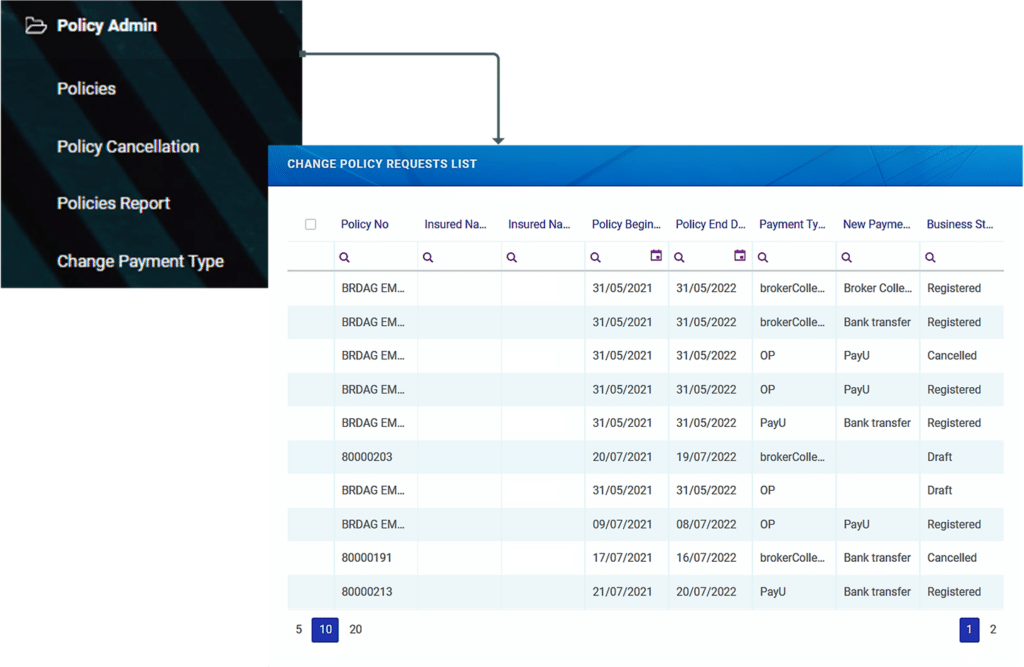

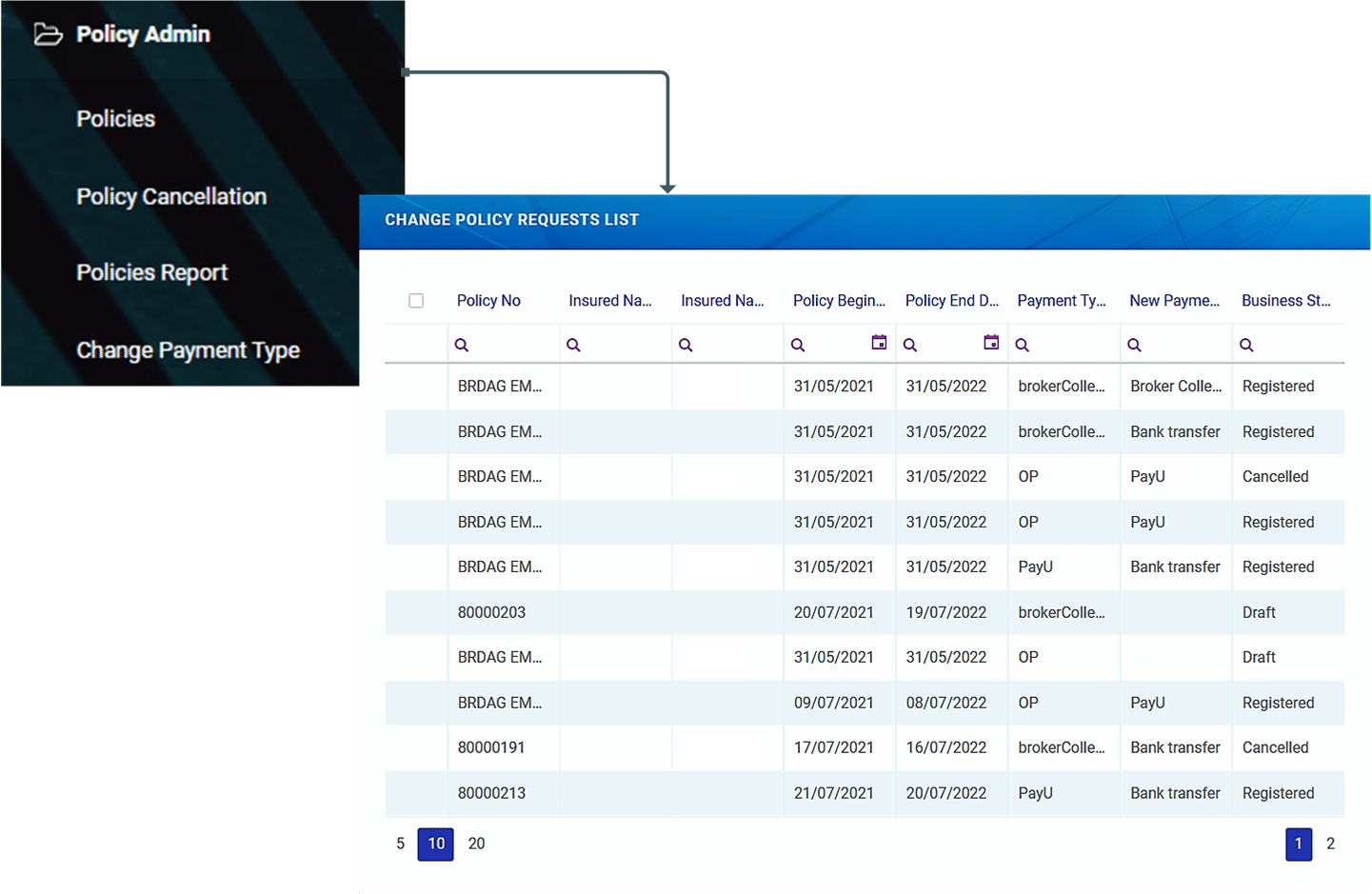

- The Change Payment Type flow – used to manage and changing the type of payment associated with a particular insurance policy.

- The Policies Report flow – provides the ability to generate reports that required for business or regulatory needs. You can easily configure the reporting period and download reports in Excel or CSV format.

- Policy Configuration – The Policy Admin module provides you with the ability to manage and record the changes to the insurance policy throughout the policy lifecycle

Check the following pages to find out more about how this solution works:

- Business Functionalities – for details about manual and automatic flows.

- Flow Parameters and Scheduled Jobs – for details about the flow parameters and scheduled jobs.

- Statuses and Transitions – for details about statuses and transitions.

- Change Payment Type Journeys – for details about the change payment type journeys.

- Policy Cancellation Journeys – for details about the policy cancellation journeys.

The complete documentation is available here.

Platform version compatibility: FintechOS Platform v21.1.5.0 and above.

Dependencies: Standard or Professional Insurance Syspack v21.1.1004 or higher.

Insurance Apps Dependencies: Insurance Product Factory v21.1.6_20, Proposal Configurator v1.0 and Core Insurance Master v1.0 – installed in this exact order.