SME Banking Single Customer View

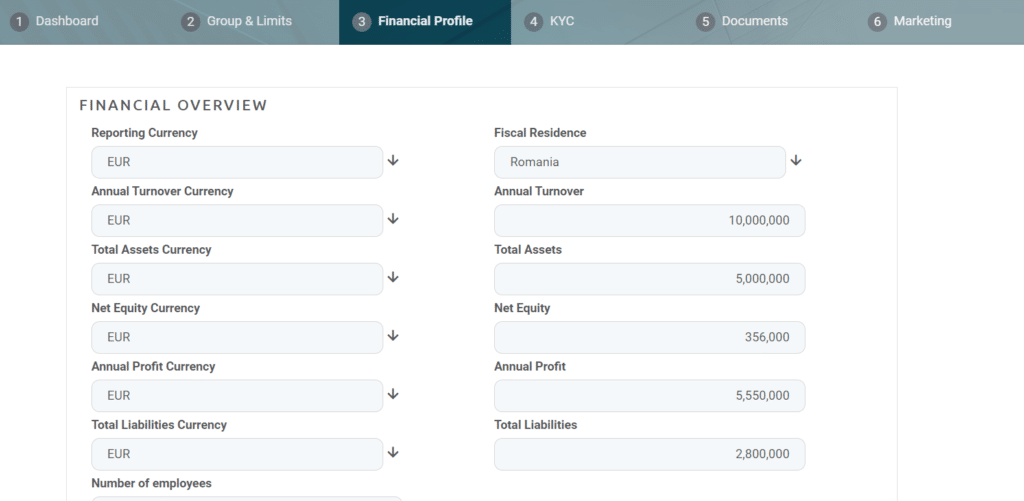

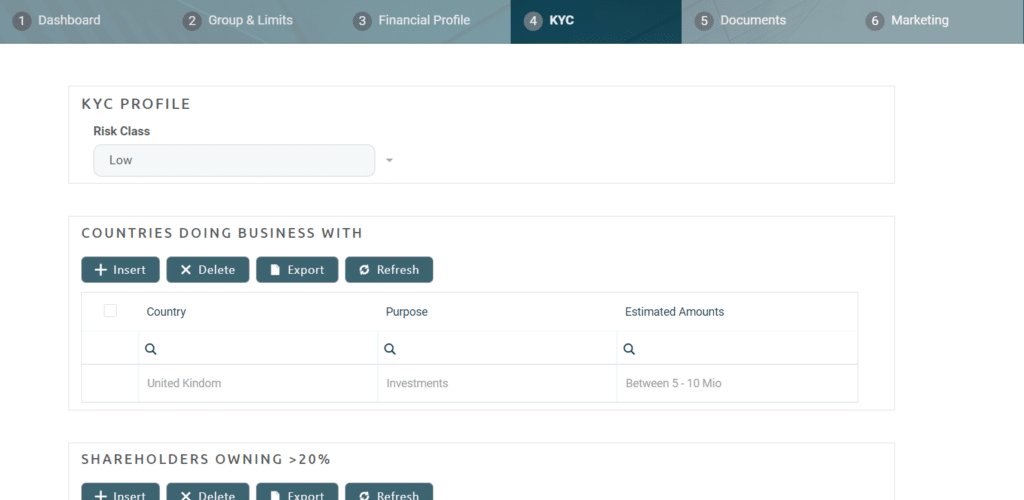

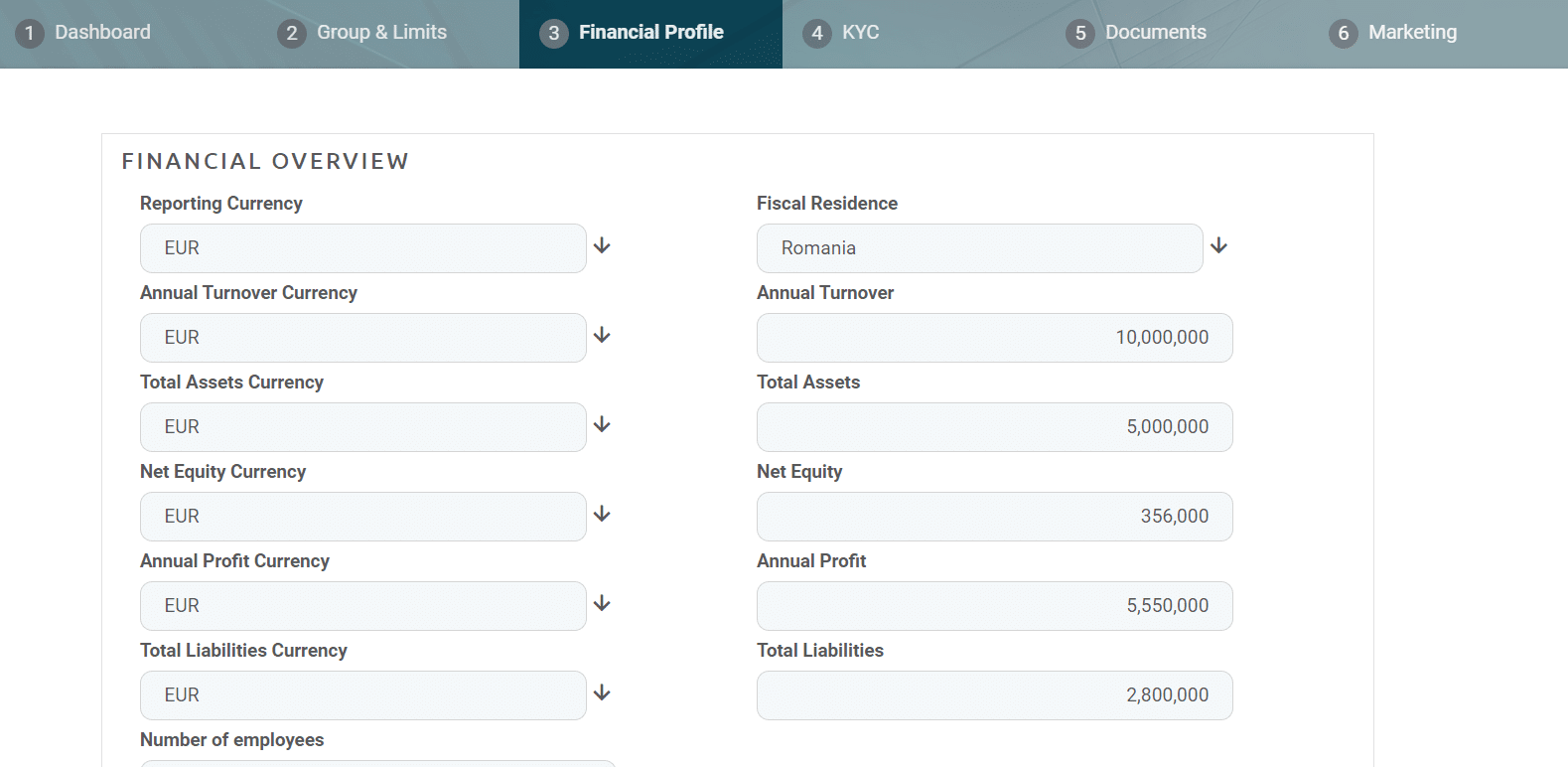

Dedicated to legal entities only, this digital journey collects, aggregates, and processes customer data in a straightforward manner. It is used by bank employees to register information they have about a customer, such as fiscal data, assets, liabilities, risk class, and agreements. It is an efficient way to organize customer data for bank records.

An accurate and personified customer record is an essential component of any data-driven initiative, being a prerequisite for better personalization, targeting, offer optimization, customer retention, and measurement. In this respect, customer data is a critically valuable asset.

This digital solution replaces the need for a customer to fill in papers. It makes it less demanding for the customer to give details about the legal entity. With the use of business units and security roles, access to customer data can be restricted to certain employees, hence, the information is safe.

Key Features:

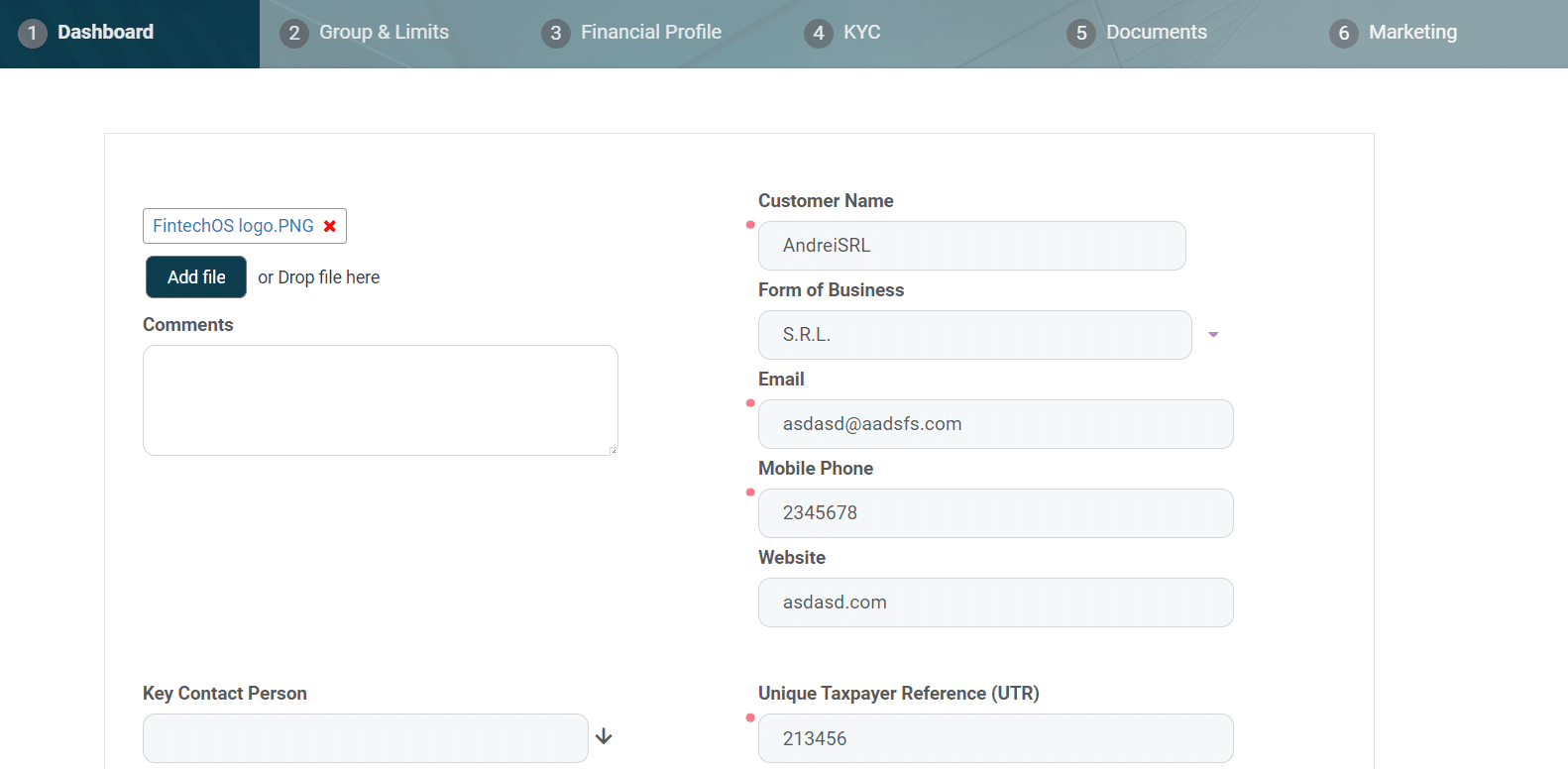

- Data is effortlessly inserted in the customers list by filling in a few indispensable fields about the customer that the bank needs.

- Data is accessible to the bank employees with security rights to view the list of customers and their data.

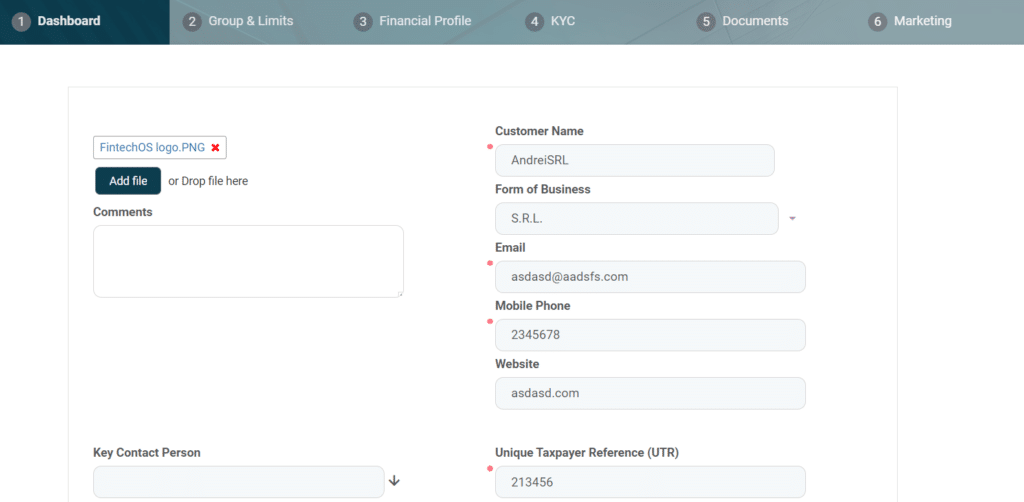

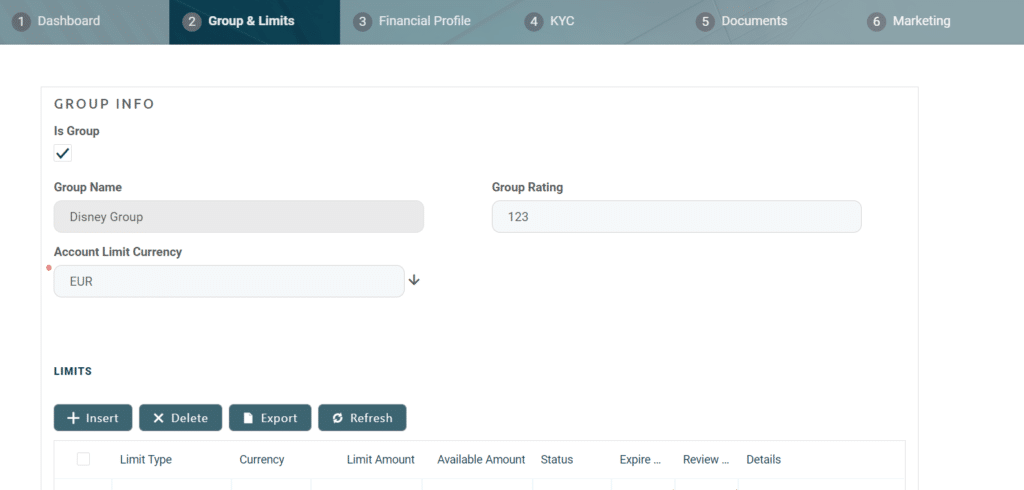

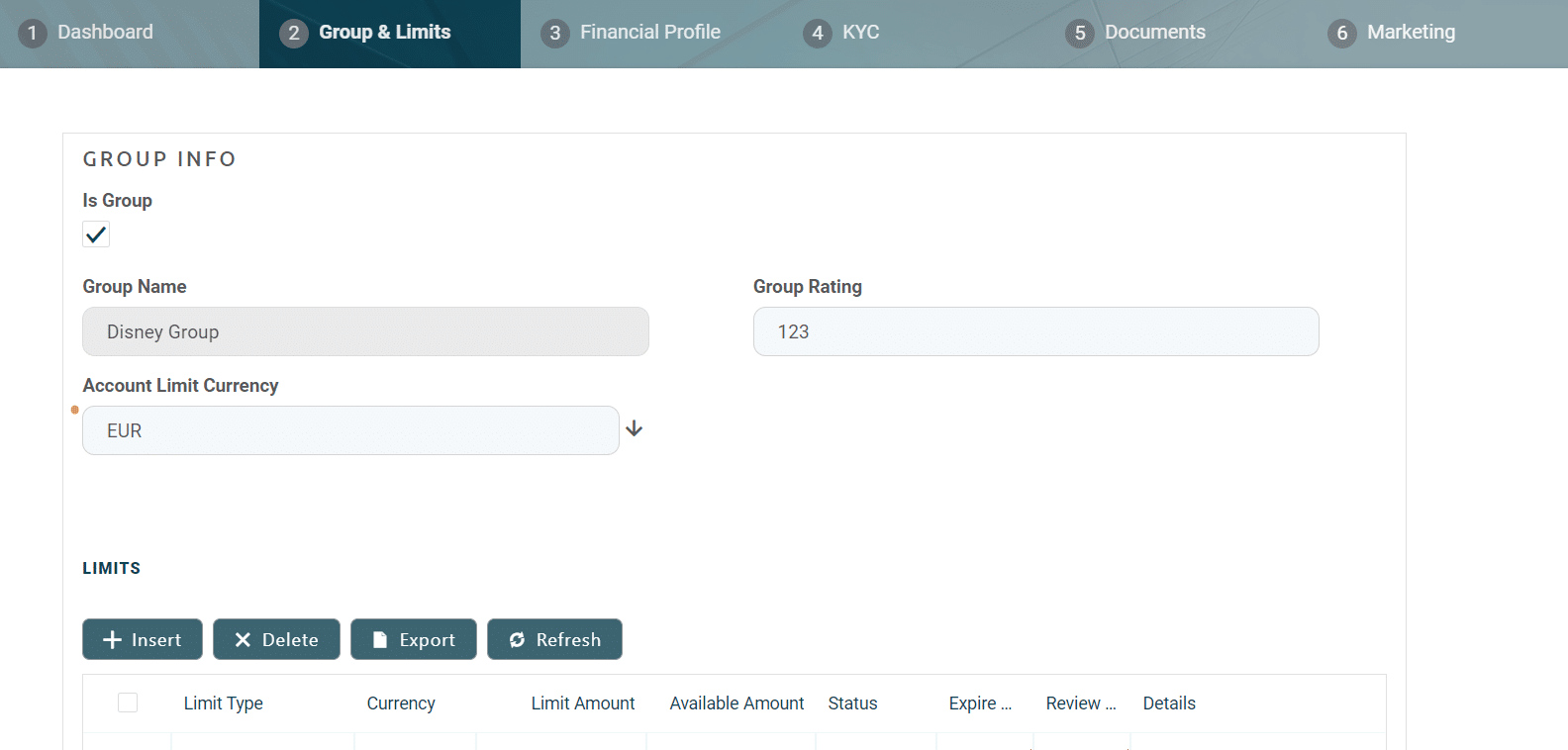

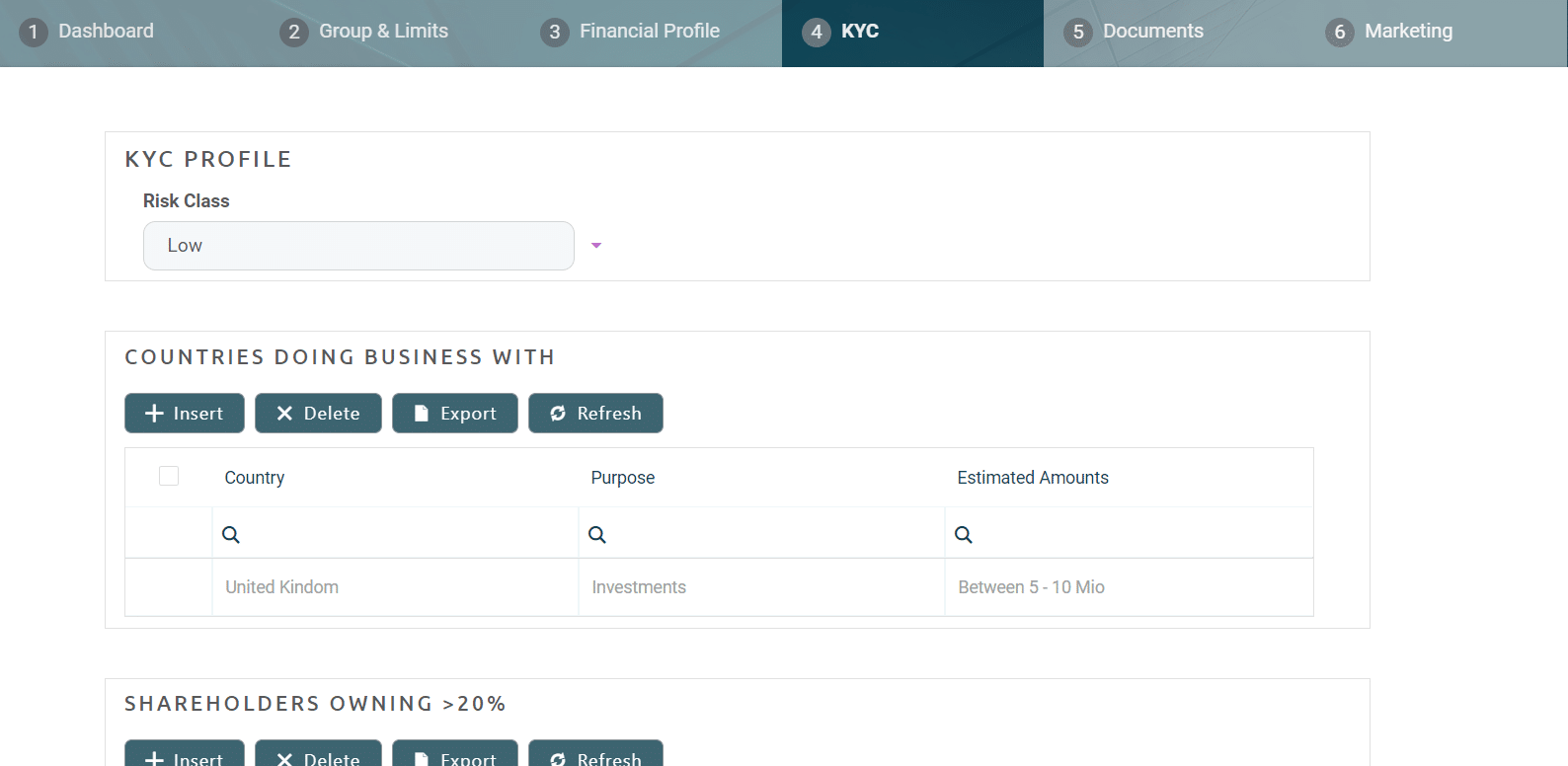

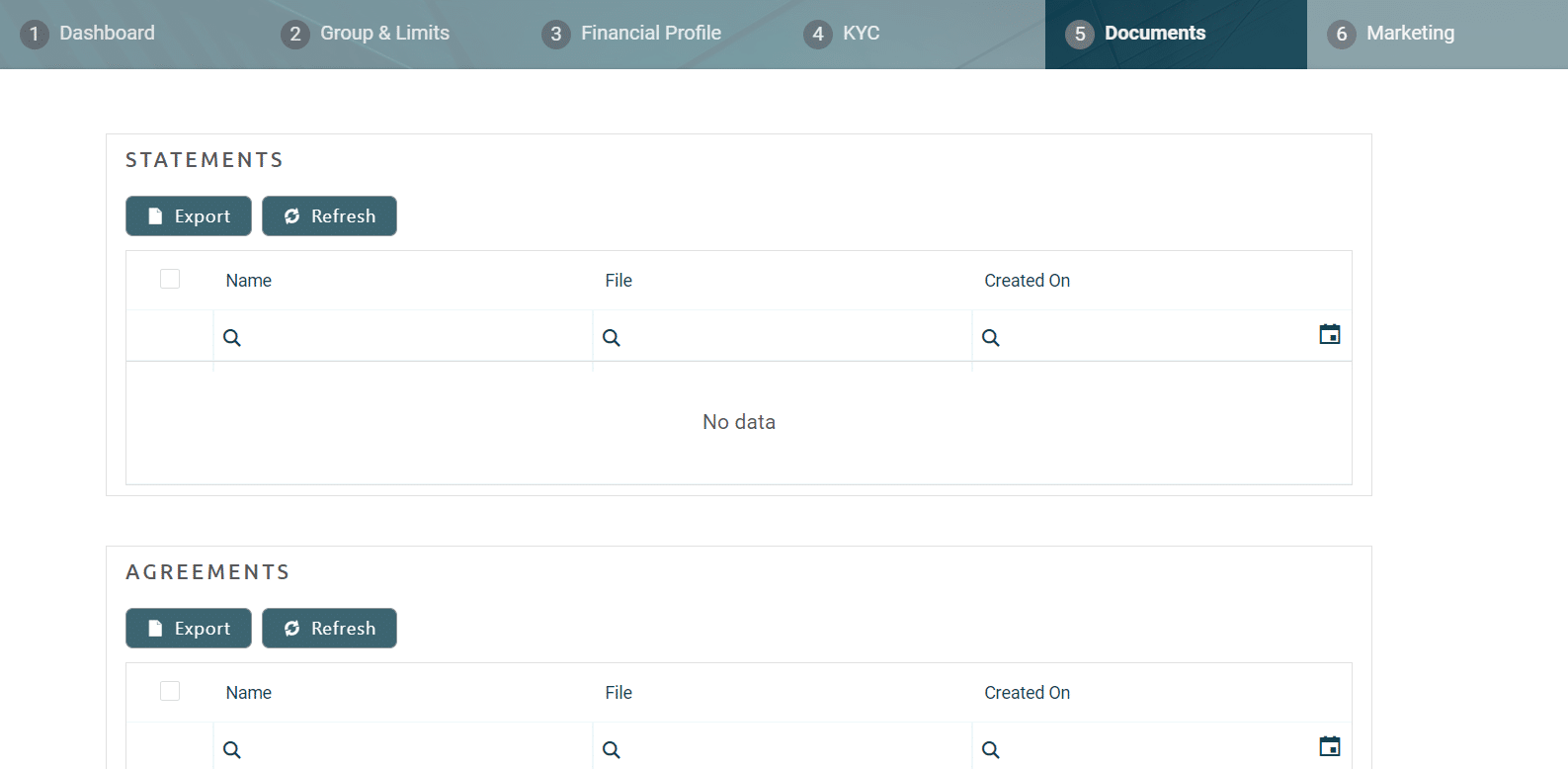

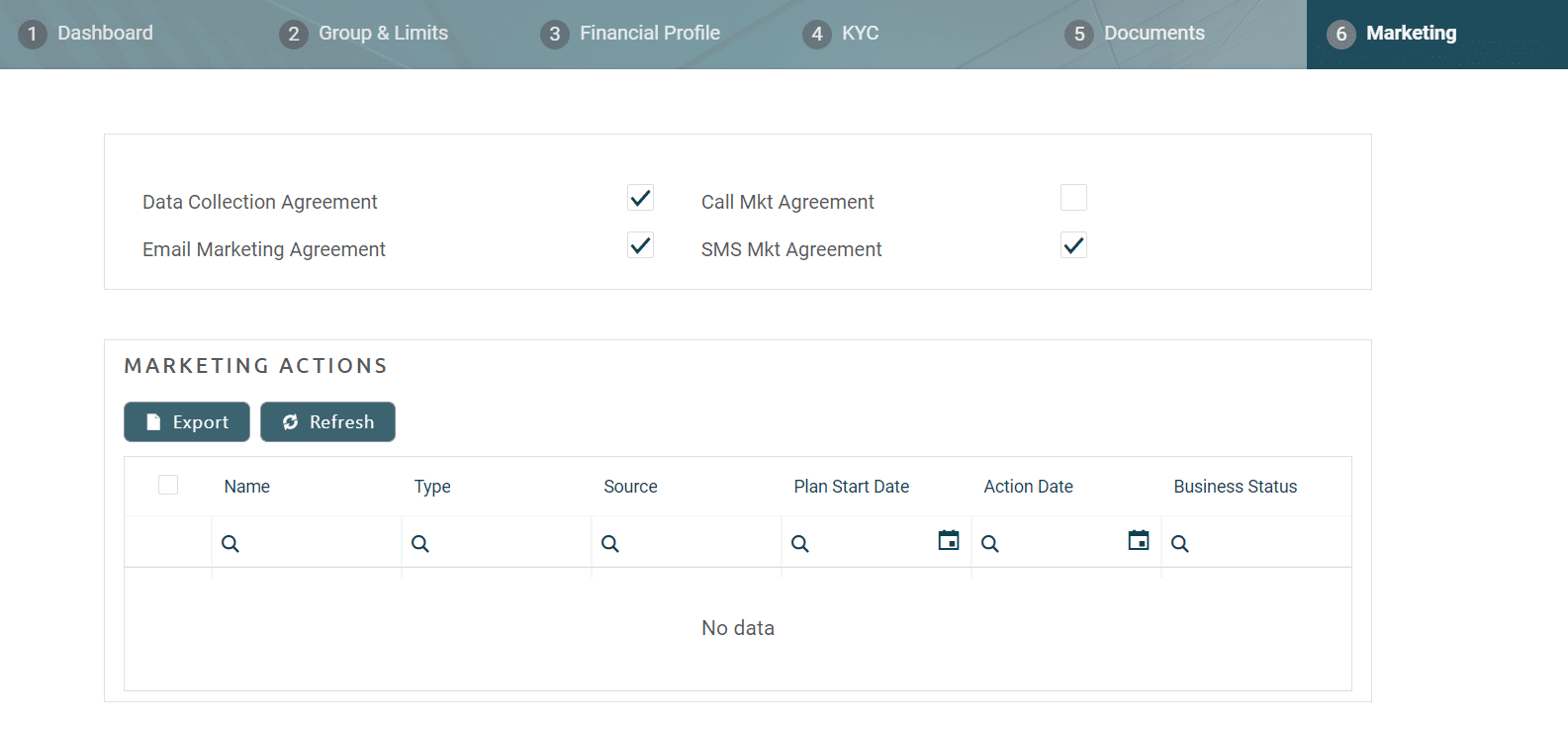

- For additional data about a customer that the bank needs, there are dedicated tabs with fields.

- Data can be deleted to make sure that the bank achieves the implementation of the GDPR requirements.

The goal of this digital journey is to gather information about a customer, and it is structured in categories to keep the data nicely organized to facilitate the process of registering a customer, and updating the details if needed. The documentation covers the instructions for a bank representative to:

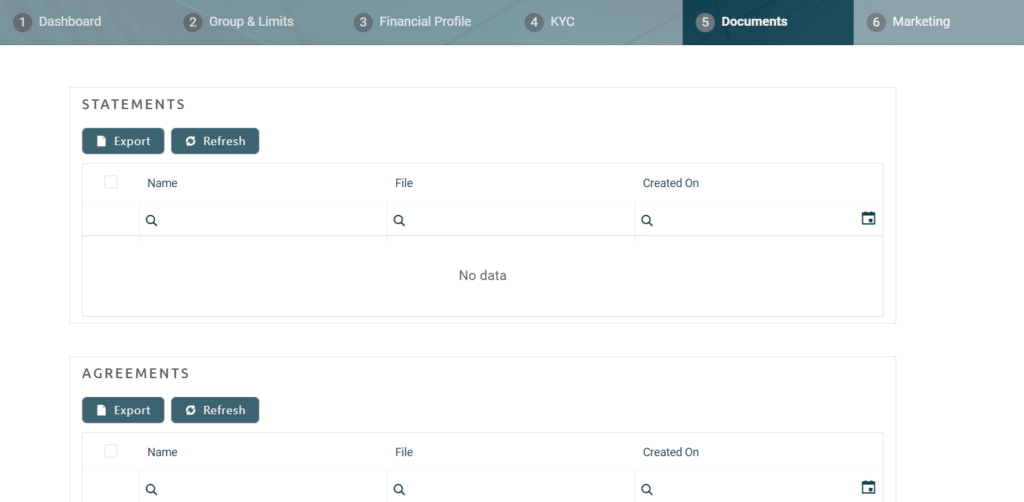

An office clerk can insert a new legal entity into the system, add financial information and store it in the database. It can be updated regularly by the users with rights, and, when the time comes, to delete the customer and their data. To add in-depth data about a Small to Medium Sized Enterprize, there are the section tabs with fields named:

These six section tabs classify the information that is related to one another to keep it systemized and easy to navigate between tabs when looking for a specific piece of information.

The complete documentation is available here.

The Single Customer View (SME Banking) app requires a FintechOS platform version V20.1.2 or higher. Verify that you have installed and configured the GenieSysPacks Professional Banking package.