SME Mobile Lending

SME Mobile Lending allows companies to apply for a loan, and receive the answer from the financial institution within a few minutes. Completely self-service for simple financing needs.

Small and medium-size business enterprises are a vital part for the economic growth and competitiveness of any country and supporting the SME’s financial needs is critical.

Banks need to offer a higher level of personalization and attention to detail to be able to be a reliable partner for the long run and have flexible solutions that meet the difficult landscape that small business owners need to operate in. Also, cost of service is always a factor of improvement that can give an edge in the continuously changing market with regards to current circumstances. As a result, lenders need to be able to make decisions quickly and accurately to help their clients get up and running and minimize risk. The SME Lending accelerator offers different functionalities for collecting and analyzing client’s financials that will improve TTY (time to yes) and crucially, TTC (time to cash).

Tailored Products: Custom tailored products are included in the accelerators with pre-loaded filters and ranking systems. The predefined products are a great place to start but if for some reason you need further configurations, using our Banking Product Factory, banks have limitless possibilities to modify, extend or define new custom offerings for their clients.

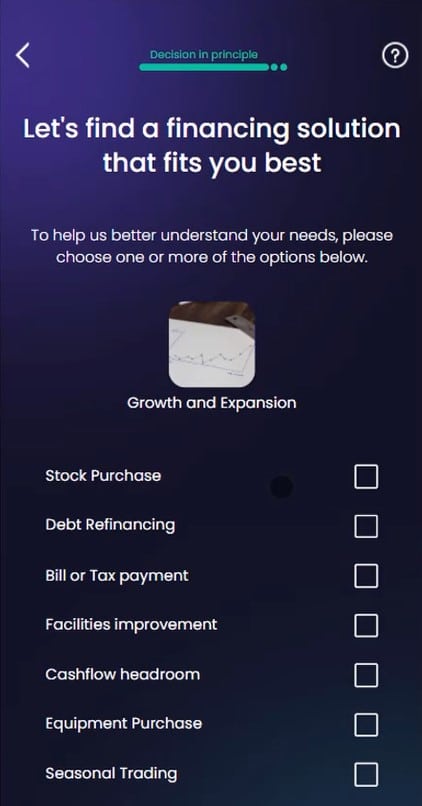

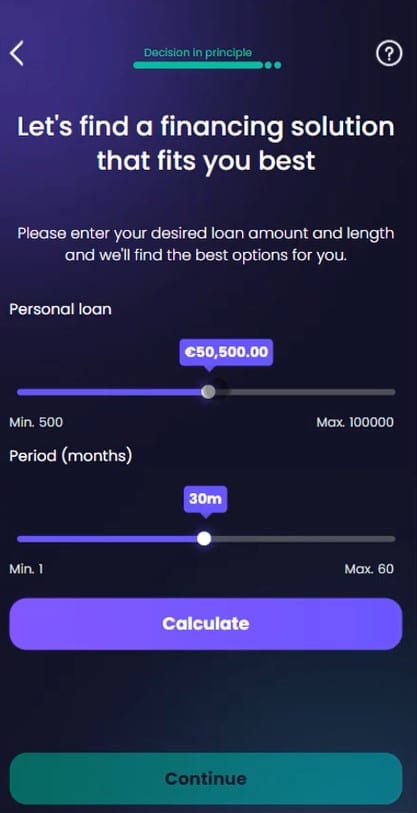

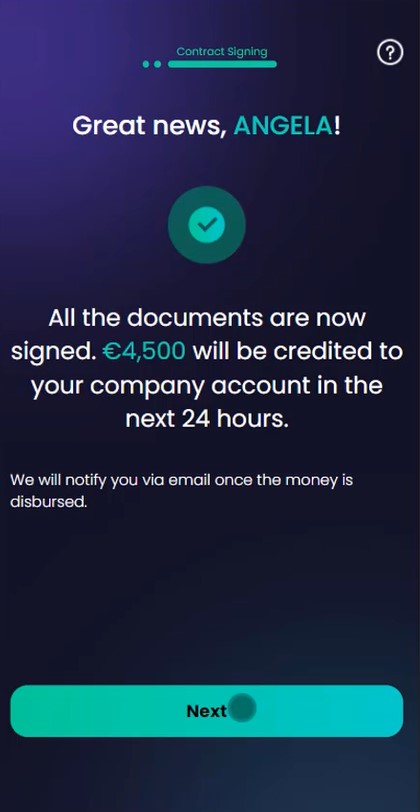

Simplified process: Simple steps guide the user from the welcome screen to the disbursement options with low friction and a fully online journey that he can get a decision from in minutes. The process doesn’t require the user to visit a branch or talk to the bank over the phone, it is entirely done whiten the application with no interaction unless demanded by the user. No paper is printed or required to complete the process.

Personalized customer experience: Specific legal and market requirements are more fluid then ever and reacting to them needs a high level of customization that challenge legacy systems. All the accelerators have included a top of line UI/UX and they are built using components that are easy to include/exclude from the journey. For example, you can choose to include a cost simulation at the beginning of the journey or you can define specific rules for the client validation steps (OTP’s required, level of KYC needed).

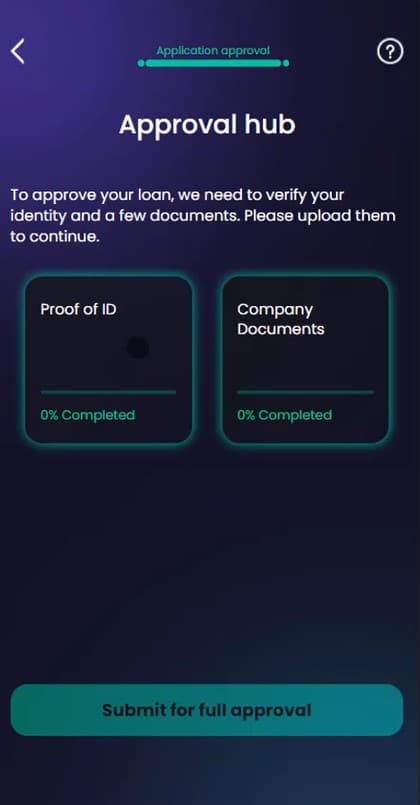

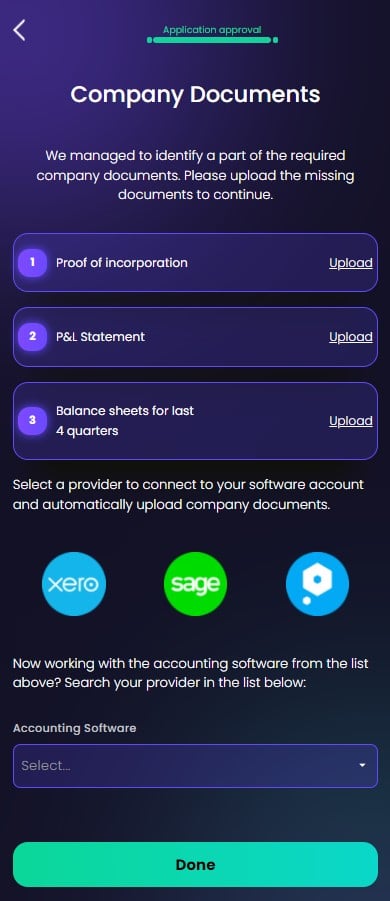

Integrations: Our solution leverages third party data seamlessly and enables critical data to be collected (KYCK process Companies House integration) and decisioned upon (fetching credit scores from Experian). Pre-integrations with third parties are available but can be easily modified to accommodate the bank’s current providers for scoring, risk management, KYC, security or any other service they need.

The SME Mobile Lending is a digital journey that allows an SME to access financing solutions in minutes. It is an end-to-end loan origination process, fully automated. This accelerator caters to the needs of digitization for financial institutions, commercial banks, credit unions, and investment banks. Any institution that is looking for a digital conversion benefits from the usage of such digital technology that is fast-track and with real-time answers.

The solution is addressed to SMEs that have a small market capitalization and present low-risk products. Additionally, the SME itself must not be part of a group, and the stakeholders themselves must not be part of other stakeholders groups. To access the financing solution, only a legal representative of the SME can apply for the loan. The SME must be a new customer to the financial institution. During this self-service journey, the representative goes through two steps: an instant decision in principle followed by the application for the approval. The process doesn’t require the user to visit a branch or talk to the bank over the phone, it is entirely done within the application with no interaction unless demanded by the customer. No paper is printed or required to complete the process.

Firstly, it identifies the needs of the customer through hyper-personalization, followed by the configuration for the amount and period with a simulation. The offering takes into account all the inputted data of the customer. Based on the amount and period requested, the system filters the products the institution has.

Shortly after, the company is identified, as well as the representative who is applying for the loan. Within a few minutes, the solution enables a loan origination service that informs the applicant if they qualify for the desired amount and period.

More details here.

Install and configure:

-

- Standard FTOS infrasturcture (with B2CPortal, B2CProxy, Jobserver, MessageBus, MessageComposer for the Contact Validation) v21.2.2 as explained here

- Product Factory v3.0.2

- OTP project (found in the folder SME Mobile Lending-v1.0.0.zip > prereq)

- Connectors: Company House is required to be installed and Experian is optional to be installed or other third-party platforms

- B2C Setup project (found in the folder SME Mobile Lending-v1.0.0.zip > prereq) OR a manually configured B2C security role assigned to the Guest user and a front-end domain named B2C.

More details here.